Advertisement|Remove ads.

Toyota’s Tokyo Stock Slides Most Since April As Profit Outlook Falls Short — Will Wall Street Echo The Selloff?

- Toyota forecast operating income of 3.4 trillion yen for fiscal 2026, missing analyst estimates as higher U.S. tariffs and export costs cut into margins.

- The automaker’s hybrid and electric lineup made up nearly half of total sales, helping offset weaker domestic demand in Japan.

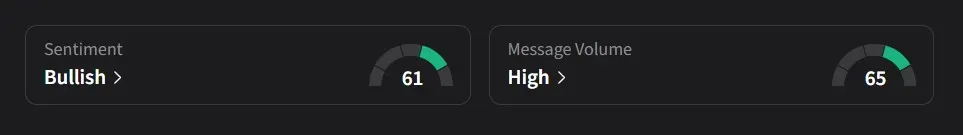

- Despite the selloff in Tokyo, retail sentiment on Stocktwits remained bullish.

Toyota Motor’s shares tumbled 3.6% in Tokyo on Wednesday, marking their steepest drop since April, after the automaker’s full-year profit outlook came in below market expectations. The decline came before U.S. trading hours, and Toyota’s U.S.-listed shares may show a similar reaction when markets reopen.

Earnings Preview

Toyota said it now expects operating income of about 3.4 trillion yen ($22 billion) for the fiscal year ending March 2026, a modest increase from its earlier forecast of 3.2 trillion yen, but well short of analyst projections near 3.9 trillion yen, according to a Bloomberg report.

The world’s largest carmaker has been feeling the impact of higher export costs and U.S. tariffs, which continued to weigh on its performance through the first half of the year.

Tariffs And Cost Pressures

Japanese automakers are under strain following a July trade agreement that raised tariffs on vehicles and parts shipped to the U.S. to 15%, up from 2.5%. Though less severe than the 25% rate once threatened, the higher duties have eaten into profits and forced Toyota to rethink pricing and production strategies worldwide.

“Sales increased mainly in Japan and North America despite the impact of U.S. tariffs,” Chief Financial Officer Kenta Kon said at a media briefing in Tokyo. He added that Toyota is monitoring potential supply risks from semiconductor supplier Nexperia BV, though the company has not yet seen any direct production impact.

Hybrid Strength Amid Uncertainty

Electrified models, including hybrids and battery-electric vehicles, made up nearly half of Toyota’s total sales in the first half of the fiscal year. Strong demand for hybrids in North America and China helped offset softer results in Japan, underscoring the company’s reliance on its hybrid lineup to sustain momentum amid global trade and cost pressures.

Stocktwits Traders Stay Bullish

On Stocktwits, retail sentiment for Toyota was ‘bullish’ amid ‘high’ message volume.

Toyota’s U.S.-listed stock has risen 7% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)