Advertisement|Remove ads.

Trent Expands Beyond Apparel; SEBI RA Palak Jain Highlights Multi-Category Growth Drivers

Trent is emerging as a multi-category retail player, growing rapidly beyond its apparel roots. And this shift is evident in its stock performance, with Trent shares rallying over 10% in the last one month.

SEBI-registered analyst Palak Jain stated that Trent is quietly compounding across segments, including footwear, innerwear, beauty, home décor, and lab-grown diamonds, now accounting for 20% of FY25 revenue, up from just 2–5% a few years ago.

According to Jain, Trent’s footwear volumes reached 54 million in FY25, outpacing Bata (50 million) and catching up to Relaxo (178 million), which has seen flat volumes since FY21.

In innerwear, Trent scaled up from 4 million units in FY21 to 50 million in FY25, equivalent to 31% of Page Industries’ volumes, up from 4% in FY21.

Trent’s beauty business has touched ₹81 crore, with additional presence in home décor and a recent entry into the lab-grown diamond space, segments with high lifestyle affinity and repeat purchase potential.

Its Zudio brand crossed ₹8,500 crore ($1 billion) in FY25 revenue, operating 765 stores across 235 cities, up from just 40 stores in 2019.

Jain said the next phase of growth will come from Tier 2 and Tier 3 cities.

She believes that Trent is no longer just an apparel story but a multi-engine consumption platform taking share from incumbents across categories.

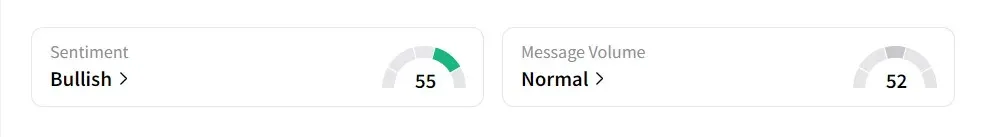

On Stocktwits, retail sentiment was ‘bullish’ amid ‘normal’ message volume.

The stock has declined 11.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)