Advertisement|Remove ads.

David Sacks Clarifies He Remains Opposed To AI Bailouts After Saying Reversal In Investments Would Risk Recession

- Sacks’ posts coincided with the announcement of the White House’s Genesis Mission, which is aimed at boosting innovation with AI.

- The Trump administration on Monday issued an executive order, announcing the Genesis Mission while stating that AI would be used to generate predictive models to accelerate federal research and development.

President Donald Trump’s AI and crypto czar, David Sacks, on Tuesday clarified that he remains opposed to any bailouts for companies in the artificial intelligence sector.

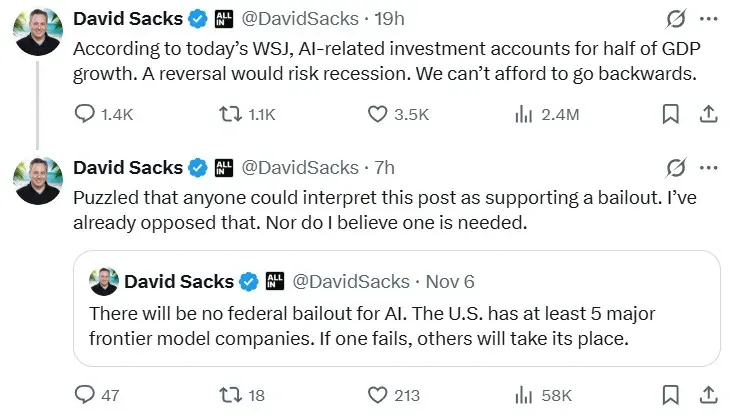

“Puzzled that anyone could interpret this post as supporting a bailout. I’ve already opposed that. Nor do I believe one is needed,” Sacks said in a post on X.

Sacks said that a reversal in AI-related investments would risk a recession, citing a report by The Wall Street Journal that stated these investments accounted for nearly half of the U.S.’s Gross Domestic Product (GDP) in the first half of the year. “We can’t afford to go backwards,” he added.

Genesis Mission

Sacks’ posts coincided with the announcement of the White House’s Genesis Mission, which is aimed at boosting innovation with AI.

The Trump administration on Monday issued an executive order, announcing the Genesis Mission while stating that AI would be used to generate predictive models to accelerate federal research and development. “The Genesis Mission brings together the unmatched power of our National Laboratories’ supercomputers and top scientific minds to transform the way science and research are conducted,” the order states.

The White House has tasked the Department of Energy (DOE) with taking charge of this mission.

Federal Backstop

Concerns about AI bailouts emerged after OpenAI CFO Sarah Friar said at a media event earlier this month that the AI startup is looking for an ecosystem of banks and private equity, as well as a federal “backstop” to help finance the company’s investments.

In a LinkedIn post later, Friar said her comments were misinterpreted. “I used the word ‘backstop’ and it muddied the point. As the full clip of my answer shows, I was making the point that American strength in technology will come from building real industrial capacity which requires the private sector and government playing their part,” Friar wrote.

Reacting to Friar’s comments, Sacks said at the time that there would be no federal bailout for AI. “The U.S. has at least 5 major frontier model companies. If one fails, others will take its place,” he said in a post on X.

Meanwhile, U.S. equities declined in Tuesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.33%, the Invesco QQQ Trust ETF (QQQ) fell 0.88%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) edged lower by 0.01%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)