Advertisement|Remove ads.

Trump's UAE Visit Lands Boeing Another Big Win: Retail Bulls Eye Profitability After $14.5B Etihad Order

Boeing (BA) stock garnered retail attention after Etihad Airways agreed to acquire 28 Boeing widebody aircraft powered by GE Aerospace engines for $14.5 billion during President Donald Trump’s visit to the United Arab Emirates.

According to the White House, the Abu Dhabi-based airline’s order includes Boeing 787 and 777X jets.

“With the inclusion of the next-generation 777X in its fleet plan, the investment deepens the longstanding commercial aviation partnership between the UAE and the United States, fueling American manufacturing, driving exports,” the White House said.

Reuters reported that Etihad Airways confirmed the purchase and added that the deal reflected the airline's "ongoing approach to aligning its fleet with evolving network and operational needs."

The company reportedly expects the planes to be delivered starting from 2028.

The Etihad agreement followed Boeing’s largest-ever order for widebody aircraft from Qatar earlier this week.

The $96 billion contract for 210 aircraft includes 130 Boeing 787 Dreamliner jets, 30 of its 777-9 jets, and an option for an additional 50 widebody aircraft.

The fresh orders have further bolstered Boeing’s order book, which stood at $460 billion at the end of the first quarter. According to the company, the book included more than 5,600 airplanes that would take over seven years to produce.

On Thursday, TD Cowen analyst Gautam Khanna said that a production ramp-up of Boeing’s best-selling 737 jets to 38 per month was “increasingly plausible.”

The analyst also said it seems realistic for the Federal Aviation Administration to lift the 38-per-month production cap on the 737 Max jets by year-end. The limitations were imposed in 2024 following a door-plug incident involving an Alaska Airlines aircraft.

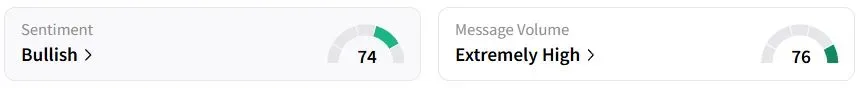

Retail sentiment on Stocktwits was in the ‘bullish’ (74/100) territory, while retail chatter was ‘extremely high.’

BA’s Sentiment Meter and Message Volume as of 02:40 a.m. ET on May 16, 2025 | Source: Stocktwits

“Just imagine what will happen with Asia now going forward. The FAA will approve production increases soon, and the company will turn the corner to profitability,” one user said.

Boeing stock has risen 15.7% year to date (YTD).

Also See: Fiserv Stock Dips After CFO Flags Volume Growth Weakness — Analyst Says Selloff ‘Seems Overblown’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)