Advertisement|Remove ads.

Trump Tariffs: Majority Of Stocktwits Users Predict Downside Risk For Market’s Over 2-Year Bull Run While Economist Calls It ‘Bully Strategy’

President Donald Trump has walked the talk and officially declared the imposition of tariffs on Canada, Mexico, and China, belying popular expectations that it was merely a threat. A Stocktwits poll suggests the action signals the start of a downturn for the high-flying market.

A statement from the White House on Saturday said the Trump administration is taking bold action to hold Mexico, Canada and China accountable for illegal immigration and the flow of poisonous fentanyl and other drugs into the country. The new administration has deemed the threat posed by “illegal aliens” and drugs, including the deadly fentanyl, as a national emergency.

The statement said Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. The tariff on energy resources from Canada would be lower at 10%.

“President Trump continues to demonstrate his commitment to ensuring U.S. trade policy serves the national interest,” the statement read.

Economists Weigh In

Commenting on the development, former Treasury Secretary and economist Larry Summers called the tariff a “bully strategy.” In a series of posts on X, Summers said, “The self-inflicted supply shock is a strategic gift to Xi Jinping.”

According to Summers, China will likely give a more open door to U.S.’ allies as America proves unreliable due to the bullying.

The economist said even as inflation remains sticky, the tariff will pose an upside risk to oil, food, and car prices, necessitating the Federal Reserve to raise rates. He sees job losses in the industrial heartland as U.S. producers can’t compete due to higher input prices.

Summer also warned of potential retaliation by Canada and Mexico.

Meanwhile, economist Mohamed El-Erian said the U.S. move could prove positive to the country in the short term but is less favorable in the long term.

Given the U.S.'s relative strength over many other countries, the approach promises gains for America in the short term, both cyclically and structurally. In the long run, however, the economist said the tariff action will prove a “repeated game” and hurt the U.S.

“The more it appeals to tariffs, the stronger the incentive for other countries to reduce their economic and financial dependence on the US and accelerate the fragmentation of an international economic order that has historically served America well,” he added.

Retail Nervous

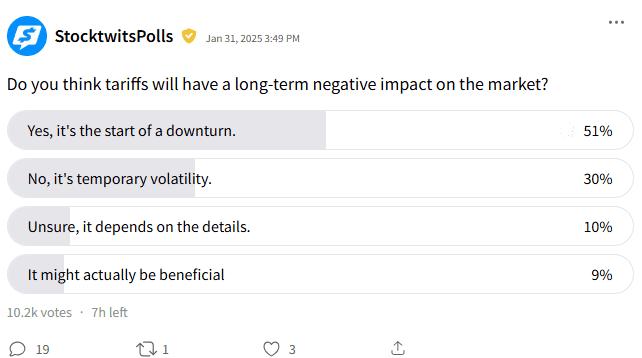

An ongoing Stocktwits poll that sought retail investors’ opinions regarding whether the tariffs will have a long-term negative impact on the market showed nervousness among this group.

Fifty-one percent of respondents said the move would mark the “start of a downturn.” A more modest 30% shrugged off the development as one that will only produce “temporary volatility.”

While 10% said they were unsure and the impact depends on the details, nearly equal proportion (9%) said it might actually be beneficial.

The stock has been on an extended uptrend since late-October 2022 as inflationary pressure began to abate.

Offering their take, a retailer said higher prices on everything will slow the economy. Another called it a “regressive sales tax.”

Underpinning the market’s nervousness, Asian stock markets fell across the board on Monday and the major U.S. and European index futures are pointing to a sharply lower opening. Crude oil futures spiked higher on supply fears.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: HubSpot Stock Gets Price Target Boost Ahead Of Q4 Results: Retail Exudes Confidence

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_jpg_24a16f95b0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)