Advertisement|Remove ads.

HubSpot Stock Gets Price Target Boost Ahead Of Q4 Results: Retail Exudes Confidence

HubSpot, Inc. (HUBS) stock, which rose about 12% in January, received a price target boost, and retail sentiment toward the stock is markedly bullish.

Jefferies analysts upped the price target for Cambridge, Massachusetts-based HubSpot from $860 to $900, suggesting a potential upside of over 15%, theFly reported.

Citing checks with HubSpot’s partners, the firm said it is increasingly confident that the company will report solid fourth-quarter results and provide positive guidance for 2025.

HubSpot, a provider of customer relationship management software that helps businesses manage their customers, sales, marketing, etc., is scheduled to report its fiscal year 2024 fourth-quarter results after the market closes on Feb. 12.

Analysts, on average, expect the company to report non-GAAP earnings per share (EPS) of $2.19 and revenue of $673.42 million for the fourth quarter. The guidance issued in early November calls for $2.18-$2.20 per share in non-GAAP earnings and $672 million to $674 million in revenue.

Investors will likely focus on key operational metrics such as subscription revenue, customer growth and average subscription revenue per customer. Subscription revenue grew 20%year-over-year (YoY) to $654.7 million in the third quarter, and customer count was up 23% to 238,128 at the end of September.

Average subscription revenue per customer dipped 2% to $11,235.4

Last week, Barclays raised the price target for HubSpot stock from $650 to $725 and maintained an ‘Equal Weight’ rating. The firm attributed the action to channel checks that indicated slightly more constructive demand environment in the fourth quarter than the previous quarter.

HubSpot completed its acquisition of artificial intelligence-powered conversation intelligence platform Frame AI in early January. Through the acquisition, HubSpot expects to accelerate its ability to unify structured and unstructured data across the customer journey at scale, empowering go-to-market teams to transform conversations into actionable intelligence.

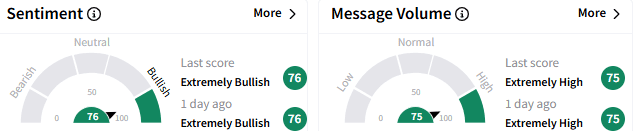

On Stocktwits, retail sentiment toward HubSpot stock stayed ‘extremely bullish’ (76/100), with message volume remaining ‘extremely high.

A stock watcher sees potential for the stock to climb as high as $840.

HubSpot stock rallied about 20% in 2024. It ended Friday’s session up nearly a percent at $779.53.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)