Advertisement|Remove ads.

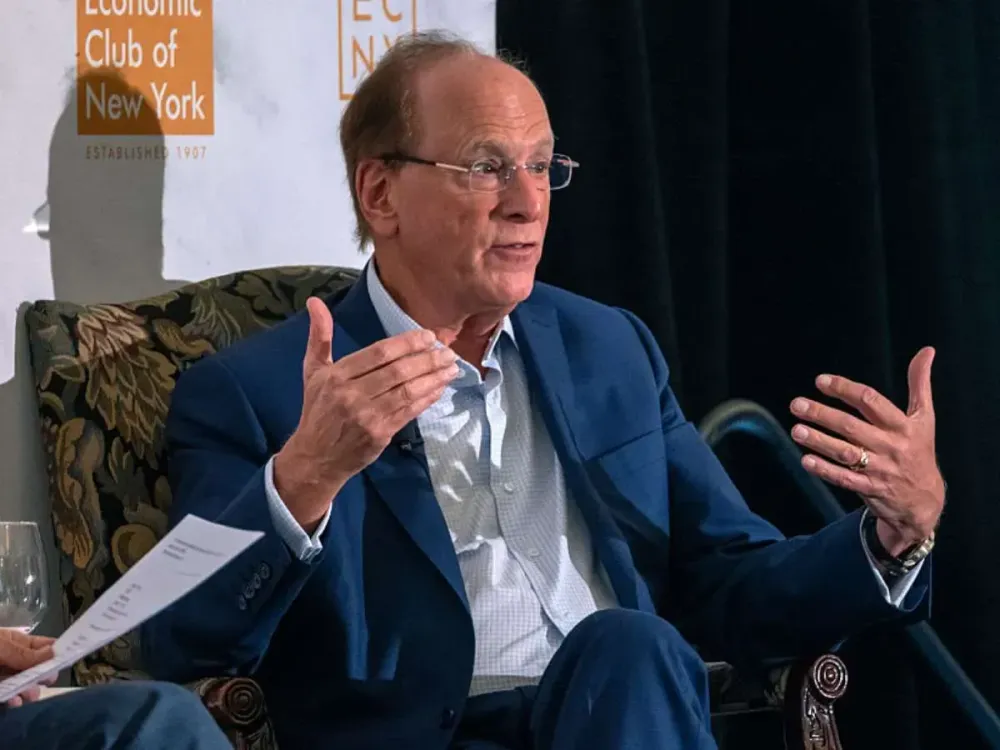

Trump Tariffs May Wipe Out 20% More From Stocks, Warns CEO Of World's Top Asset Manager: 'Going To Freeze More And More Consumption'

After enduring the worst week since the pandemic, the stock market could bleed more, according to a top Wall Street executive.

CNBC reported on Monday that BlackRock CEO Larry Fink said most CEOs believe the U.S. is already in a recession and stock markets could fall by 20% more.

“One CEO specifically said the airline industry is a proverbial bird in a coal mine — canary in the coal mine — and I was told that the canary is sick already,” Fink reportedly said.

The chief executive of the world’s largest asset manager also said that the tariffs imposed by President Trump could raise inflation and make it difficult for the Federal Reserve to cut interest rates.

“This notion that the Federal Reserve is going to ease four times this year, I see zero chance of that. I’m much more worried that we could have elevated inflation that’s going to bring rates up much higher than they are today,” Fink reportedly said.

Wall Street’s major indices, the S&P 500 and Dow & Jones Industrial Average, closed down 0.2% and 0.9% lower on Monday.

Markets were roiled last week after President Donald Trump slapped a base 10% tariff on all imports, with some countries facing even higher reciprocal tariffs.

Stocks were battered even further after China imposed reciprocal 34% tariffs on all U.S. goods, effective Thursday. On Monday, Trump warned about imposing further 50% tariffs on Beijing.

According to a Reuters report, Fink also said that the tariffs represented "more of a buying opportunity than a selling opportunity" in the long term and did not pose systemic risks.

"That doesn't mean we can't fall another 20% from here too," Fink reportedly said.

He added that the stock market turbulence "is going to freeze more and more consumption,” which might be visible soon.

The SPDR S&P 500 ETF Trust (SPY) was trading 1.2% higher in premarket, while the Invesco QQQ Trust, Series 1 (QQQ) was up nearly 1% at the time of writing.

Also See: Spire Global Stock Spikes On Settling Litigation With Kpler, Retail Mood Brightens

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)