Advertisement|Remove ads.

TSS Stock Jumps On AI-fueled Q1 Results, Strong Guidance: Retail Exuberance Abounds

TSS, Inc. (TSSI) shares soared in Thursday’s post-market session after the Round Rock, Texas-based company announced sharp increases in quarterly profits and revenue. The company also issued positive commentary for the remainder of the year.

The IT services company reported earnings per share (EPS) of $0.12 for the first quarter of the fiscal year 2025, compared to breakeven results a year ago and $0.08 reported for the preceding quarter.

The company designs, deploys, equips, and manages data centers and other technology environments for enterprise companies, colocation providers, and technology company partners.

Revenue climbed 523% year-over-year to $99 million, with the sequential growth at 98%. The company noted that procurement services revenue, making up over 90% of the total revenue, climbed 676%.

Adjusted earnings before interest, taxes, and depreciation (EBITDA) improved to $5.2 billion from the year-ago’s $475,000.

Darryll Dewan, CEO of TSS, said, “We are off to a strong start in 2025, with exponential increases in both our top and bottom lines, driven by robust growth in our Procurement and Systems Integration segments, including incremental contribution from AI rack integration services.”

The CEO said the company began initial production at its new facility last week. He added that he expects production volumes to grow in the second quarter and continue to ramp throughout the remainder of 2025 and into 2026.

“Based on our current visibility, and within the ever-changing geopolitical environment, we continue to expect total revenue in the first half of 2025 to exceed total revenue in the second half of 2024,” he added.

The company also said it expects full-year 2025 adjusted EBITDA to be at least 50% higher than 2024.

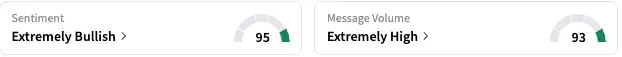

On Stocktwits, sentiment toward TSS stock was ‘extremely bullish’ (95/100) by late Thursday, with the message volume at an ‘extremely high’ level.

The stock was among the top ten trending tickers on the platform early Friday.

A bullish user called the earnings' stellar' and hoped for the stock to hit a new all-time high.

Another user commended the company on the earnings beat but said they would look for only day or swing trading opportunities.

The TSS stock jumped 51.07% in Thursday’s after-hours trading but is down about 25% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)