Advertisement|Remove ads.

It’s Raining Price Target Hikes For Uber As Bernstein Joins The Party: Retail Chatter Soars 50% Over Past 7 Days

Bernstein raised its price target on Uber Technologies (UBER) to $110 from $95 on Monday, following a similar move by Morgan Stanley.

The new price target implies an upside of over 21% to the stock’s closing price on Friday. Bernstein kept its ‘Outperform’ rating on the shares.

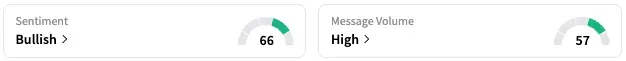

On Stocktwits, retail sentiment around Uber trended in the ‘bullish’ territory, accompanied by ‘high’ levels of retail chatter.

According to Stocktwits data, retail chatter about Uber has increased by 5% over the past 24 hours and by 50% over the past seven days, driven by multiple price target upgrades and partnerships aimed at accelerating its autonomous vehicle deployment capabilities.

On Sunday, Morgan Stanley raised its price target to $115 from $95 and maintained an ‘Overweight’ rating.

Bernstein expects continued stability in mobility and delivery segment trends at Uber to be largely positive.

Considering Uber’s reinvestment mandate, Bernstein sees more upside to out-year estimates, as these efforts bolster gross bookings growth. Uber's reinvestment mandate refers to its strategic decision to reinvest profits back into the company rather than maximizing short-term shareholder returns.

From here, the upside lies more in Uber's ability to compound free cash flow than in the multiple, though a wide gap remains compared to DoorDash (DASH). Concrete data points around autonomous vehicle (AV) fragmentation are likely needed to drive various upside, the firm added.

Bernstein doesn't expect much to change on the AV front this quarter.

Uber stock traded 0.3% higher in the pre-market session on Monday. The stock is up by over 50% this year and by about 34% over the past 12 months.

Read Next: Pinterest Sees Surge In Retail Buzz As Ad Efficiency Drives Morgan Stanley Upgrade

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)