Advertisement|Remove ads.

Uber, Lyft Stocks Rally as Tesla’s Robotaxi Announcement Falls Flat: Retail Turns ‘Extremely Bullish’

Shares of Uber (UBER) and Lyft (LYFT) surged over 8% on Friday morning following a lackluster response from investors to Tesla’s (TSLA) ‘Robotaxi event’ held late Thursday.

Since Tesla CEO Elon Musk provided few details on his plans for the Robotaxi or Cyber Cab, Uber and Lyft have no immediate timelines to worry about. According to Bank of America (BofA) Securities analyst Justin Post, while some concerns still linger for Uber investors, the announcements “did not fully live up to fears”.

The firm expects increasing competition between Alphabet-backed Waymo (GOOG), Tesla, and the other 30 autonomous vehicle (AV) competitors in California to benefit Uber, given its position as a partner to multiple AV providers. The brokerage reiterated its ‘Buy’ rating and $88 price target on Uber shares.

BMO Capital analyst Brian Pitz also reaffirmed his ‘Outperform’ rating on Uber, setting a price target of $92. In a research note, Pitz highlighted Uber’s global presence and scale as key advantages over Tesla, while noting that Elon Musk has yet to provide details on scaling the Cyber Cab initiative.

BMO Capital expects Uber to remain the “primary distribution partner” with autonomous vehicles. The firm estimates that Tesla would have to spend about $100 billion to match Uber’s driver supply levels.

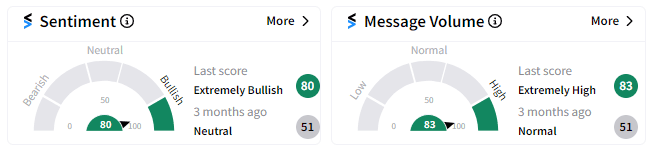

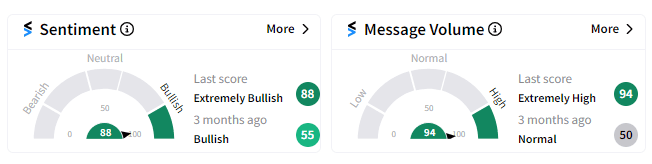

Retail sentiment on Stocktwits for Uber and Lyft is currently trending in the ‘extremely bullish’ territory, accompanied by ‘extremely high’ message volumes. Both were among the top twenty trending tickers on Stocktwits on Friday morning.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)