Advertisement|Remove ads.

Nvidia, AMD, TSMC Or Broadcom: Which Beaten-Down Chip Stock Do Retail Traders Prefer Amid Trump Tariff Chaos?

Despite rebounding on Monday, semiconductor stocks are still not back up on their feet completely following the hit from President Donald Trump’s sweeping reciprocal tariffs.

Most of the biggest semiconductor companies have their supply bases concentrated in China or Taiwan, which have invited tariff rates of 54% and 32%, respectively. This explains the weakness of their shares, which trade in bear territory.

As valuations have become attractive, some of these semiconductor stocks could be back in favor.

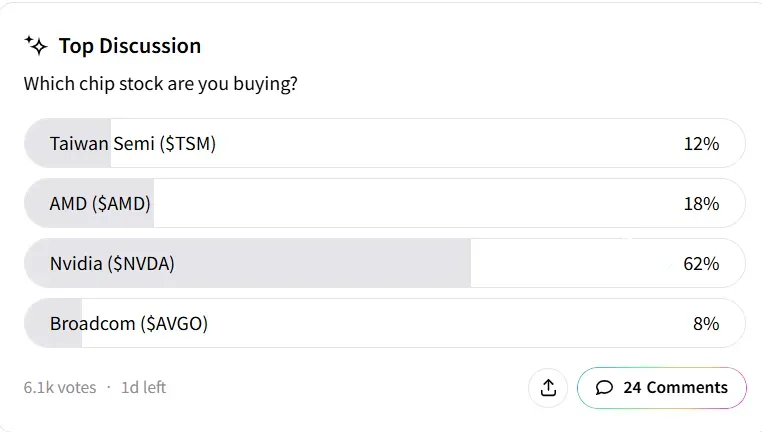

An ongoing Stocktwits poll asking users which major semiconductor stocks they would accumulate during the pullback has drawn over 6,000 responses.

Nvidia (NVDA) was the clear favorite, with 62% of users choosing the AI chip leader. AMD followed with 18%, while Taiwan Semiconductor (TSMC), the world’s top foundry, garnered 12%. Broadcom (AVGO) trailed with just 8% of the vote.

Nvidia is the most valued chip maker in terms of market capitalization, followed by TSMC and Broadcom. AMD ranks eighth in terms of market valuation.

The year-to-date losses for these companies are as follows:

- Nvidia: down 30%

- TSMC: down 26%

- Broadcom: down 33%

- AMD: down 31%

Nvidia is down a steeper 36% from its recent highs, while TSM stock has lost 35%.

With the sell-off, the forward price-earnings multiples (P/E) have moderated to 21.6 for Nvidia, 14.2 for TSMC, 23.3 times for Broadcom and 17.9 times for AMD, according to Koyfin. Taiwan-based TSMC is the most attractive among four on P/E basis.

The optimism around chip stocks is premised mainly on their attractive valuations following the sell-off. A bullish user said sitting on the sidelines was just a “hatred for money.”

Another user, who is bullish on Nvidia, said the stock has managed to reclaim the lower trendline of the descending channel.

They believe the Nvidia stock could return to the $105 area or even retest the $115 level. But they cautioned that Tuesday’s price action will be critical for confirmation.

Analysts are still hopeful that impacted nations will initiate dialogues with the Trump administration and work out a resolution.

Reuters reported that Taiwan is looking to offer zero tariffs as a basis for talks with the U.S. and will not impose retaliatory tariffs.

On Monday, the iShares Semiconductor ETF (SOXX) rallied 2.31% to $161.27. The SOXX ETF has lost 25% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Diodes, TI Stocks Outpace Tech Peers After Analyst Upgrades: Retail Traders Upbeat

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)