Advertisement|Remove ads.

UBS Hikes Gold Price Forecast Again, Expects $4,900 Peak By Mid-2026: Report

- Gold has been on a phenomenal run this year, rising over 55%.

- UBS said that macro drivers, including Federal Reserve rate cuts, lower real yields, and geopolitical tension, should continue to support demand.

- Earlier this week, Goldman Sachs said that it expects gold to reach $4,900 by the end of 2026.

Gold's relentless 55% rally this year seems far from over, according to UBS, which has raised its mid-2026 upside target for the metal to $4,900 per ounce.

UBS believes that the macro forces that powered it to record highs should keep the safe-haven demand strong into 2026.

Although gold has eased about 7% from last month’s record high of $4,381.6 per ounce, brokerages remain optimistic, continuing to lift their upside price forecasts.

UBS Raises Mid-Year 2026 Prices Forecast

On Thursday, UBS raised its upside price target to $4,900 per ounce from $4,700, with the bank arguing that the fundamentals driving this year’s surge remain firmly in place heading into 2026, according to a report by investing.com.

The investment bank continues to rate the metal as ‘attractive’, maintains long exposure in its global asset allocation, and says gold “remains an effective portfolio hedge even at current levels.”

What’s Driving The Target Hike?

UBS analysts, led by strategist Wayne Gordon, said the recent consolidation has not altered the outlook and now expect prices to reach $4,500 per ounce by mid-2026, up from a previous forecast of $4,200 per ounce. The bank has maintained its downside case at $3,700 per ounce, the report read.

UBS said that the key macro drivers, including further Federal Reserve rate cuts, lower real yields, and geopolitical tension, should continue to support demand. The analysts also highlight growing political noise ahead of the U.S. midterm elections, which could spur additional safe-haven buying.

They expect prices to consolidate near $4,300 following political events in late 2026, but see scope to reach the new $4,900 upside case if global political and financial risks intensify.

UBS’s view echoes recent bullish commentary from Goldman Sachs, which also sees gold hitting $4,900 by the end of 2026 with further upside if investors continue diversifying their portfolios.

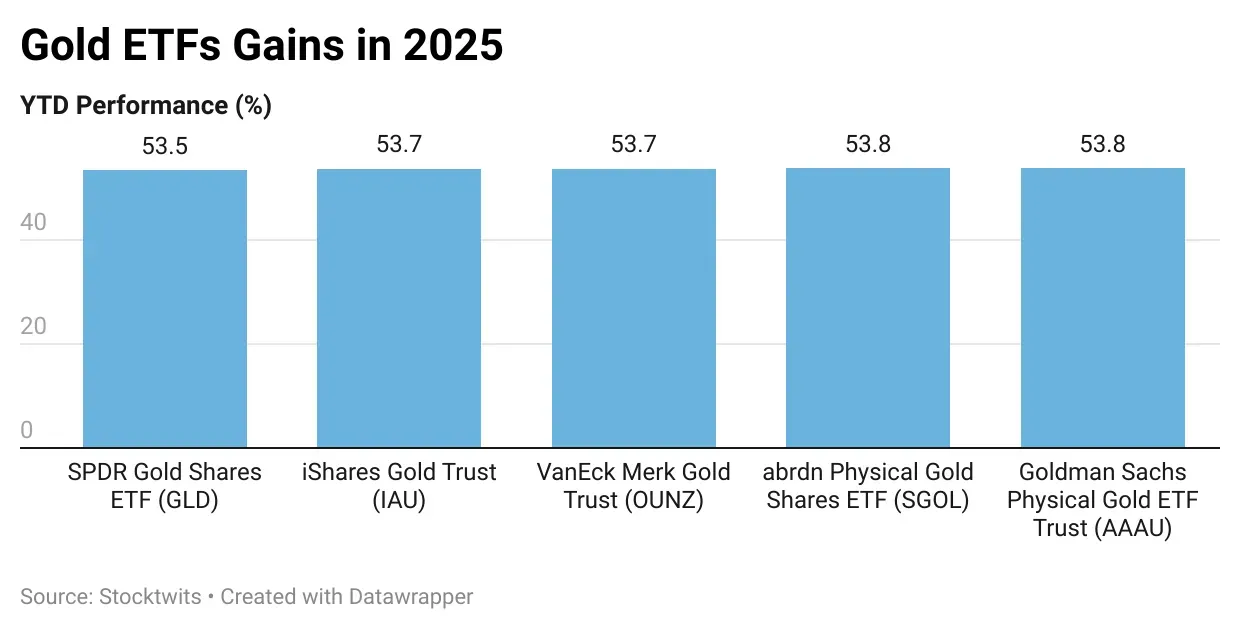

How Have The ETFs Performed?

Since the start of the year, SPDR Gold Shares ETF (GLD) has gained 53.5%, iShares Gold Trust (IAU) and VanEck Merk Gold Trust (OUNZ) have both climbed 53.7%, while abrdn Physical Gold Shares ETF (SGOL) and Goldman Sachs Physical Gold ETF Trust (AAAU) have risen 53.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)