Advertisement|Remove ads.

UiPath Stock Jumps Pre-market On Strong Q2, Raised Outlook: Retail Sentiment Flips To ‘Extremely Bullish’

Shares of software firm UiPath Inc (PATH) surged 9% in Friday’s pre-market session as of 8:48 a.m. ET after the firm reported upbeat second-quarter (Q2) earnings and raised its full-year outlook.

UiPath reported earnings per share of $0.04 versus an estimate of $0.03 while revenue rose 10% year-over-year (YoY) to $316 million, compared to analyst expectations of $303.74 million and higher than the firm’s prior guidance of $300 million to $305 million.

The highlight, however, came in the form of an improvement in the full-year guidance. UiPath now expects to report revenue in the range of $1.42 billion to $1.43 billion compared to a previous guidance of $1.41 billion to $1.41 billion. Annualized renewal run-rate (ARR) is expected in the range of $1.665 billion to $1.670 billion as of January 31, 2025 compared to an earlier guidance of $1.660 billion to $1.665 billion.

CEO Daniel Dines noted the firm’s conversations with its customers and partners has deepened its conviction that there is an increasing need for AI and automation. “As we look to the remainder of the year, we will continue to focus on product innovation, customer-centricity, and driving operational efficiencies across the business,” Dines said.

The stock also received several analyst upgrades. Bank of America reportedly raised its price target to $18 from the previous $16, while keeping a ‘Neutral’ rating on the stock. Wells Fargo has reportedly increased the price target to $15 from $14 while keeping an ‘Equal Weight’ rating.

The firm also announced two important developments along with its earnings. UiPath’s board has given its nod for an additional share repurchase program, authorizing the company to repurchase up to $500 million of its Class A common stock. The firm also stated that Ashim Gupta will be taking on an expanded role as Chief Operating Officer in addition to his responsibilities as Chief Financial Officer, effective Sept. 5, 2024.

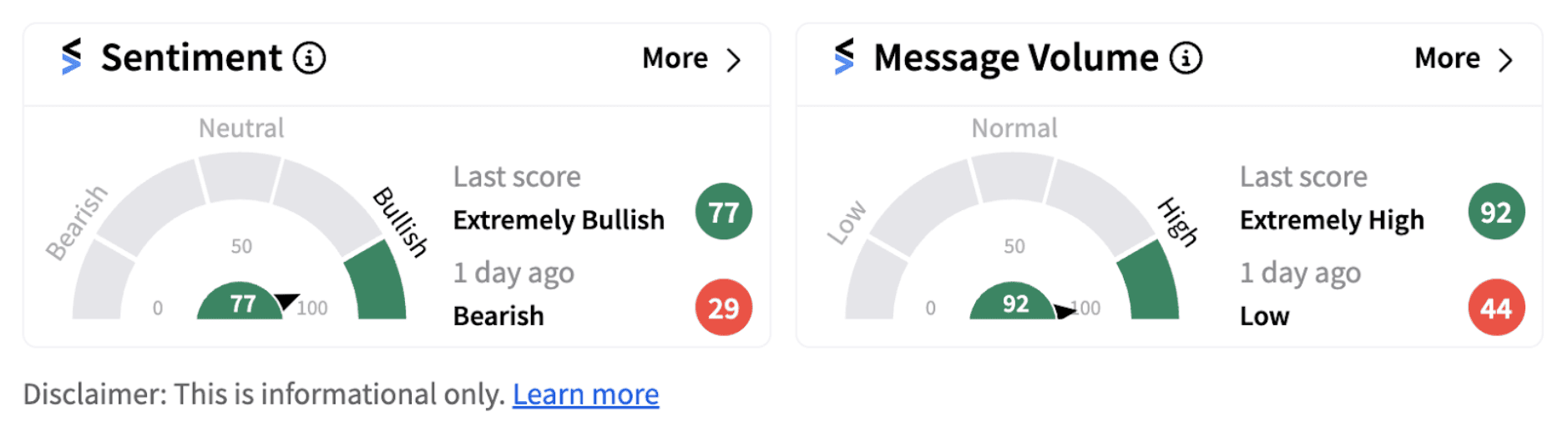

Following the strong Q2 report, retail sentiment on Stocktwits jumped into ‘extremely bullish’ territory (77/100) from ‘bearish’ a day ago, accompanied by message volume hitting one-year high.

One user named ‘CowBoE’ praised the firm’s stock repurchases saying it demonstrates financial strength.

However, it is notable that the stock is down over 46% this year and trades way below its 200-day moving average of $18.79.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203271662_jpg_17b2d32174.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)