Advertisement|Remove ads.

Goldman Sachs CEO Predicts M&A Boom On 'Tremendous Backlog' As Regulatory Tide Turns: 'CEOs Are Unleashed'

- Solomon said there is a greater appetite for investments in Chinese companies than 12 months ago, after valuations became more attractive.

- “We went through a period for four years during the Biden administration when, if you wanted to do something significant from an M&A perspective, whatever the question was, the answer was no.” — Solomon.

- Goldman Sachs reported a 42% jump in investment banking revenue in the third quarter on higher advisory fees.

Goldman Sachs CEO David Solomon said that the bank is witnessing a “tremendous backlog” of significant consolidating situations over the next two years amid a favorable regulatory environment.

“CEOs are unleashed in believing that they have a chance in doing things to advance their positions, to advance their scale,” Solomon said to Bloomberg Television in an interview during Hong Kong’s annual financial summit.

The CEO of the Wall Street bank added that the large-cap mergers and acquisitions are “quite constructive” in the U.S., especially in 2026 and 2027. The bullish commentary comes after Goldman Sachs reported a 42% jump in investment banking revenue in the third quarter, driven by higher advisory fees amid a boom in capital raises and deals.

“We went through a period for four years during the Biden administration when, if you wanted to do something significant from an M&A perspective, whatever the question was, the answer was no. We are now in an environment where whatever the question is, the answer is maybe,” Solomon said.

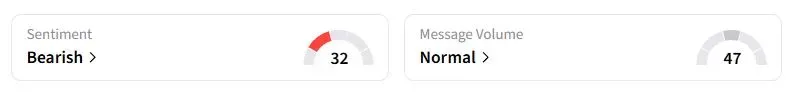

U.S. regulators under the Trump administration have been more lenient toward large-scale mergers, aiding executives in chasing large-scale deals such as the $85 billion merger between Norfolk Southern and Union Pacific. Retail sentiment on Stocktwits about Goldman Sachs was in the ‘bearish’ territory at the time of writing.

Chinese Firms Looking More Attractive, But Concerns Remain

He added that there is a greater appetite for investments in Chinese companies than 12 months ago, after valuations became more attractive; however, investors remain cautious.

“Foreign direct investment in China has come down, and I think one of the big questions is, until we understand the trade and the geopolitical landscape, it’s harder to see significant shifts back to higher levels,” Solomon said. “But for the moment, those flows are making for a better IPO market.”

Additionally, Solomon expressed optimism about improvements in the business environment after China and the U.S. agreed to extend their trade truce by a year, which he believed would provide ample time for the two sides to sign a trade agreement.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)