Advertisement|Remove ads.

United Airlines Topped Analyst Estimates On Earnings, Pushes Retail Sentiment Deeper Into Extremely Bullish Territory

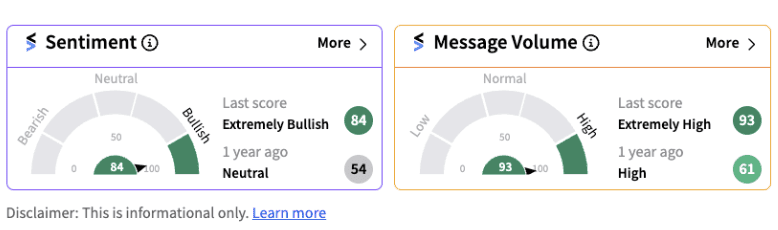

Shares of United Airlines were trading over 1% higher on Thursday after the firm reported an upbeat set of earnings for the second quarter. The firm announced earnings per share of $4.14 compared to a Street estimate of $3.93. Revenue came in at $14.99 billion, slightly lower than an estimate of $15.06 billion. Retail sentiment brightened for the stock with the sentiment meter traveling deep into extremely bullish territory (84/100) supported by a one-year high in message volumes.

United said its premium revenue grew 8.50% in the second quarter versus the same quarter last year, while the Basic Economy revenue grew 38% year-over-year (YoY).

The airline witnessed a 27.20% YoY rise in its operating income during the quarter to $1.93 billion. Meanwhile, net income rose 23.10% YoY to $1.32 billion. The company reiterated expectations of full-year 2024 adjusted diluted earnings per share of $9-$11.

United Airlines CEO Scott Kirby said multiple airlines have begun to cancel loss-making capacity, and the firm expects leading unit revenue performance among our largest peers in the second half of the third quarter. “United has long been preparing for the moment when industry-wide domestic capacity would adjust - it's now clear that the inflection point is just 30 days away,” he said.

The airline has reduced its debt by voluntarily prepaying the remaining $1.80 billion outstanding balance of the MileagePlus term loan with a nearly 11% interest rate during July.

Meanwhile, TD Cowen has increased the price target on the airline stock to $80 from $65. The firm has a ‘Buy’ rating on the stock. Given that United Airlines is currently trading near the $47 mark, the new price target leaves a potential upside of 41%.

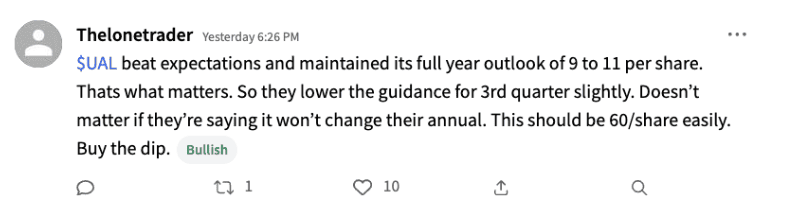

A Stocktwits user named ‘Thelonetrader’ expressed optimism about the stock, saying it could reach $60 per share.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)