Advertisement. Remove ads.

Universa Founder Mark Spitznagel Reportedly Believes A Recession Is Imminent: ‘Looking For A Crash That We Haven't Seen Since 1929’

Mark Spitznagel, chief investment officer and founder of Universa, believes the first rate reduction by the Federal Reserve shows a recession is imminent in the U.S., according to a Reuters report. "The clock is ticking and we are in black swan territory," he says.

Spitznagel and his firm were detailed in Scott Patterson’s book “Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis.” Universa specializes in tail-risk hedging strategy that gives outsized returns when there’s significant turmoil in the markets. The firm uses various derivative instruments like credit default swaps and stock options to profit from severe market movements.

Spitznagel believes the disinversion of the Treasury yield curve signals that a contraction is imminent. The treasury yield curve, which compares two- and 10-year yields, was inverted for the past two years. But in recent weeks, it has turned positive.

The Reuters report compares this to historic patterns where that curve witnessed disinversion a few months before the economy started contracting. "The clock really starts when the curve disinverts, and we're here now," Spitznagel said.

The Universa founder is of the view that a recession is around the corner which will force the central bank to aggressively reduce rates and then eventually adopt quantitative easing. "I do think they'll save the day again ... I feel strongly that QE is coming back and rates are going to go back to something like zero again," he said.

On Friday, the personal consumption expenditures price index came in lower-than-expected at 2.2%. This implies price rises are closer to the Fed’s target and supports the case for further easing of the policy.

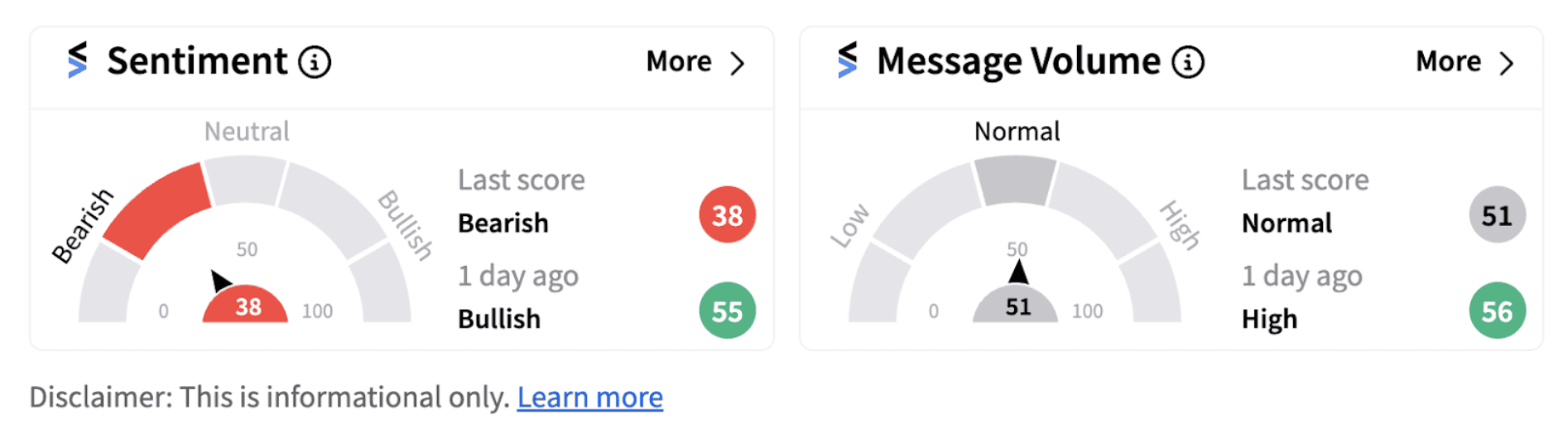

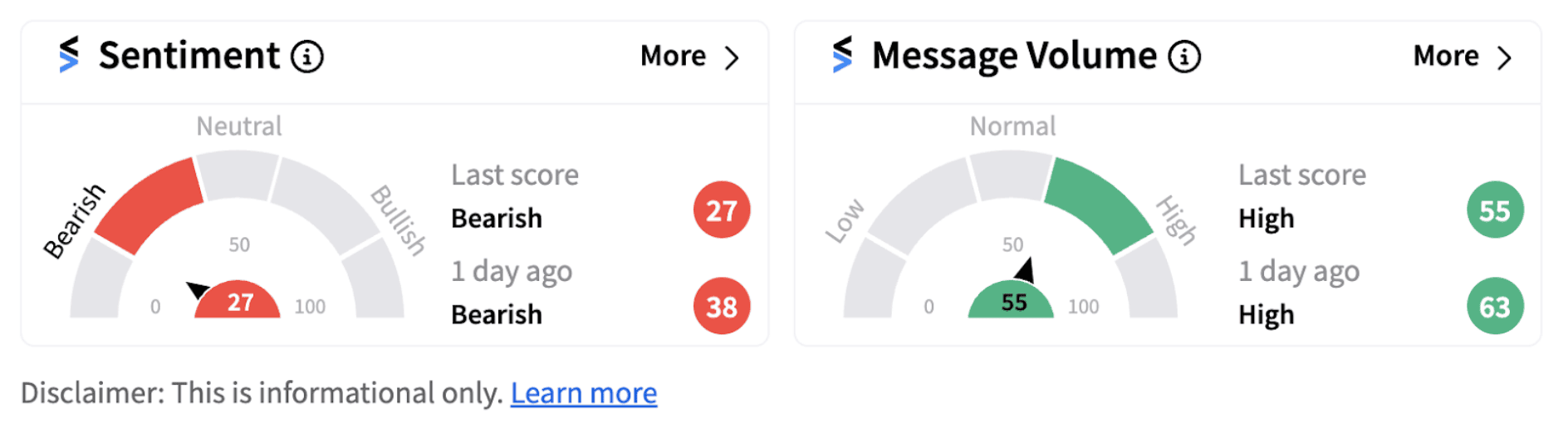

Following the release of the data, major indices traded mixed. The SPDR S&P 500 ETF Trust (SPY) was down over 0.02% while the Invesco QQQ Trust, Series 1 (QQQ) lost over 0.5% on Friday. Stocktwits users were ‘bearish’ on these ETFs on Friday.

Universa specializes in making money out of turmoil and that’s why, when it says something about a potential crash, the market pays attention. "The Fed hiked rates into such a huge, unprecedented debt complex ... That's why I say I'm looking for a crash that we haven't seen since 1929,” said Spitznagel.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232877160_jpg_16a992c009.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tylenol_OG_jpg_771dcc056c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/05/jk-tyre-2024-05-c7ecbc39af1dfd9ed2a4fe5cd3b92cec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198449525_jpg_a39857bed0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2232701393_jpg_081651ea01.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)