Advertisement|Remove ads.

Coinbase Reportedly Eyes Buyout Of India’s CoinDCX On The Cheap Weeks After $44M Hack: Will It Tilt Retail Bears?

Coinbase is reportedly in advanced discussions to acquire Indian cryptocurrency exchange CoinDCX at a valuation of less than $1 billion.

According to a report by the Indian publication Mint, citing people familiar with the matter, Coinbase sees the potential deal as a long-term strategic bet. The rumored talks come amid CoinDCX’s efforts to recover from a theft, where hackers stole $44 million after targeting an internal account used to provide liquidity to customers. No customer funds were reportedly lost.

CoinDCX was valued as high as $2.2 billion three years ago. According to the report, a deal at “this discounted valuation is essentially a low-cost gamble,” as Coinbase seeks to position itself to capture gains if the Indian crypto market booms. The largest U.S. crypto exchange already owns stakes in CoinDCX and its rival CoinSwitch.

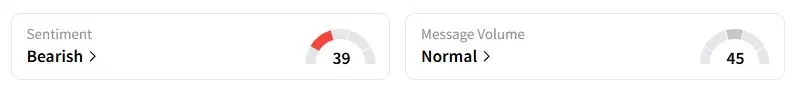

Retail sentiment on Stocktwits about Coinbase was still in the ‘bearish’ territory at the time of writing.

Coinbase might also consider combining its stakes in both CoinDCX and CoinSwitch, India’s most valuable crypto exchange. According to the report, while formal talks are yet to be underway, a merger of the two portfolio companies “is likely, but not yet on the table." CoinSwitch reportedly said it was not in active discussions about a merger with CoinDCX.

Separately, Jefferies raised the price target of Coinbase stock to $405 from $260. The new price target implied a 6.7% upside compared to the stock’s closing price on Monday.

According to The Fly, the brokerage said that, despite the recent hype surrounding stablecoins, the USDC market cap has only increased by 5% since early May. Jefferies also said it is "fine-tuning" its institutional take rate and methodology for modeling the USDC revenue share.

The company is scheduled to report its quarterly earnings on July 31 after the bell.

Coinbase stock has jumped nearly 48% this year, aided by a rally in cryptocurrency asset prices.

Also See: Gold To $4,000? Fidelity Thinks It’s Possible By 2026 On These Catalysts

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)