Advertisement|Remove ads.

US Antimony, Americas Gold Launch JV To Push Domestic Antimony And Critical Minerals Growth: Retail Says It’s A ‘Game Changer’

- The JV will process copper, silver, and antimony mined by Americas while generating downstream profits from previously untapped antimony production.

- The hydromet plant will be built on land contributed by USAS adjacent to its active mining operations in Idaho's Silver Valley.

- Once operational, USAS will be compensated for antimony mined at market rates and share 51% of the JV’s downstream processing profits.

United States Antimony Corp. (UAMY) announced a strategic joint venture (JV) with Americas Gold and Silver Corp. (USAS) on Tuesday to build a hydrometallurgical processing facility in Idaho.

The new partnership aims to strengthen domestic critical mineral production while lowering processing costs and improving profitability.

Joint Venture’s Structure

The venture will be structured with Americas Gold and Silver holding a 51% stake and US Antimony holding a 49% stake, with the latter acting as the managing member. All major decisions will be overseen by a joint committee with equal representation from both companies.

The JV will process copper, silver, and antimony mined by Americas while generating downstream profits from previously untapped antimony production.

Following the announcement, United States Antimony stock traded 5% higher and was the top-trending equity ticker on Stocktwits.

What Are Stocktwits Users Saying?

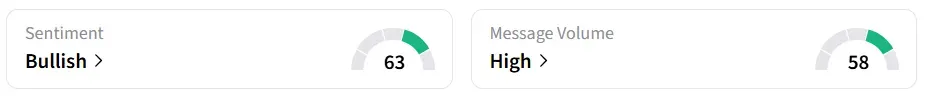

On Stocktwits, retail sentiment around the stock changed to ‘bullish’ from ‘extremely bullish’ territory the previous day amid ‘high’ message volume levels.

A Stocktwits user called the stock ‘a long-term play’.

Another user lauded the announcement, calling the JV a ‘game changer’.

U.S. Critical Mineral Push

The hydromet plant will be built on land contributed by USAS adjacent to its active mining operations in Idaho's Silver Valley.

“As we all know, our country is playing ‘catch-up' today with our adversaries, and we are combining today both of our financial and management resources to more quickly make advancements in the U.S.-based critical mineral space.”

-Gary C. Evans, Chairman and CEO, US Antimony

Once operational, USAS will be compensated for antimony mined at market rates and share 51% of the JV’s downstream processing profits. The collaboration will provide a fully integrated, U.S.-based mine-to-product solution for antimony, a mineral critical to defense, electronics, and industrial applications.

UAMY stock has gained over 309% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_72608012_jpg_3da2f4e2a2.webp)