Advertisement|Remove ads.

US Engaging With Norway About Wealth Fund’s Divestment Of Caterpillar Stake Over Gaza Atrocities

The Trump administration reportedly stated on Wednesday that the U.S. was directly engaging with Norway over the divestment of Caterpillar stock by the country's $2 trillion wealth fund.

"We are very troubled by the Norwegian sovereign wealth fund's decision, which appears to be based on illegitimate claims against Caterpillar and the Israeli government," a U.S. State Department spokesperson said, according to a Reuters News report.

"We are engaging directly with the Norwegian government on this matter," the spokesperson reportedly stated.

The State Department’s remarks follow a suggestion by Republican Senator Lindsey Graham to impose tariffs and deny visas to Norwegians following the divestment.

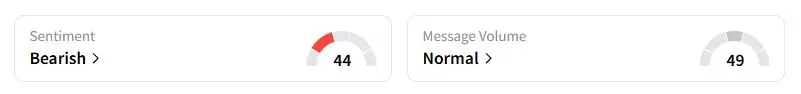

Retail sentiment on Stocktwits about Caterpillar was in the ‘bearish’ territory at the time of writing.

Norges Bank Investment Management, responsible for managing the $2 trillion fund, had excluded Caterpillar from its holdings, alongside five Israeli banks, on ethical grounds. The changes in holding were made in accordance with the fund's ethics watchdog, called the Council on Ethics.

The six entities were excluded “due to an unacceptable risk that the companies contribute to serious violations of the rights of individuals in situations of war and conflict,” the fund said. It held a 1.17% stake in Caterpillar, valued at $2.1 billion as of June 30.

The ethics watchdog alleged that the basis of the exclusion was that Israeli authorities are using bulldozers manufactured by Caterpillar in the “widespread unlawful destruction of Palestinian property.”

“In the Council’s assessment, there is no doubt that Caterpillar’s products are being used to commit extensive and systematic violations of international humanitarian law,” the Council of Ethics said in the recommendation issued on July 2, before adding that the company also has not implemented any measures to prevent such use.

Caterpillar stock has gained 13.6% this year, but has fallen 3.7% over the past month. Last week, the company flagged that it expects a tariff hit of up to $1.8 billion in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strategy_logo_OG_jpg_fa4e1a7d04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232490693_jpg_6d25778555.webp)