Advertisement|Remove ads.

US, Taiwan Reach Deal To Cut Import Tariffs, Boost Chip Investment In America

- Taiwan will provide credit guarantees of at least $250 billion for additional investment by its companies in the U.S.

- Taiwanese companies that build new chip capacity in the U.S. will be permitted to import up to 2.5 times planned capacity without additional tariffs during the construction period.

- Companies from the island that complete new chip production projects in the U.S. will be allowed to import 1.5 times their new U.S. production capacity without paying additional tariffs.

The United States and Taiwan have reached a trade agreement that will reduce tariffs on goods imported from the island and boost investment in the U.S. semiconductor industry.

According to a statement from the U.S. Department of Commerce, the tariff rate on Taiwanese goods will now be 15%, down from 20% before.

Taiwanese semiconductor companies will also make direct investments of at least $250 billion to build and expand the semiconductor industry in the U.S., as per the statement.

Taiwan will also provide credit guarantees totalling at least $250 billion for additional investment by Taiwanese companies in the U.S.

As per the department, the “historic trade deal will drive a massive reshoring of America’s semiconductor sector” and “strengthen U.S. economic resilience, create high-paying jobs, and bolster national security.”

Additional Perks

In addition, levies on Taiwanese auto parts, timber, lumber, and wood derivative products have also been capped at 15%, while reciprocal tariffs for generic pharmaceuticals, aircraft components, and unavailable natural resources have been removed, as per the fact sheet.

The U.S. has also committed to rewarding Taiwanese semiconductor companies that invest in the country. Companies that build new chip capacity in the U.S. will be permitted to import up to 2.5 times planned capacity without additional tariffs during the construction period, with a lower tariff rate applicable for above-quota imports.

Taiwanese companies that complete new chip production projects in the U.S. will be allowed to import 1.5 times their new U.S. production capacity without paying additional tariffs.

The deal comes as a Supreme Court decision on the legality of President Trump’s global tariffs is expected.

Impact On TSMC

While the fact sheet did not explicitly name Taiwan Semiconductor Manufacturing Corporation (TSM), the trade deal is likely to have an impact on Taiwan’s largest chip manufacturer.

As per an earlier report from The New York Times on the deal, TSMC is likely to commit to building at least five more semiconductor facilities in the U.S. state of Arizona.

Last year, TSMC expanded its U.S. investment to $165 billion, pledging to build three fresh fabrication plants, two new advanced packaging facilities, and a research and development team center.

Earlier on Thursday, TSMC reported fourth-quarter (Q4) earnings results, clocking in revenue of NT$1.046 trillion, a growth of 20.5% from a year ago, and a profit surge of 35%. The company also said that it would increase its 2026 capital expenditure by 37% to $56 billion.

How Did Stocktwits Users React?

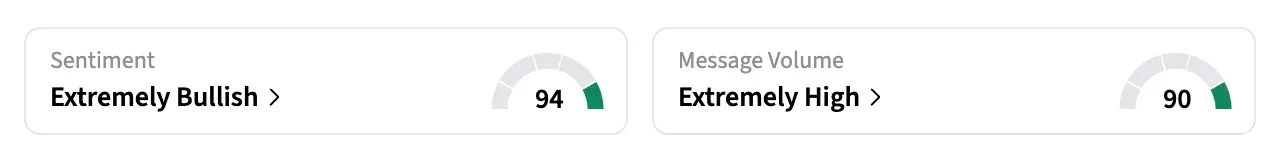

On Stocktwits, retail sentiment around TSM stock jumped to ‘extremely bullish’ from ‘bullish’ a day ago, while message volume increased to ‘extremely high’ from ‘high’ levels.

Shares of TSM rose over 5% on Thursday at the time of writing and have gained over 66% in the past year.

Shares of the iShares Semiconductor ETF (SOXX), which tracks U.S.-listed semiconductor stocks, were up 2.5% at the time of writing and have gained over 52% in the past year.

Meanwhile, U.S. equities were in green in Thursday’s mid-day trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.25%, the Invesco QQQ Trust ETF (QQQ) gained 0.39%, and the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.58%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202862389_jpg_c0559f1ff4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ELF_Beauty_unsplash_056135126b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_logo_OG_jpg_b2a06ae10a.webp)