Advertisement|Remove ads.

India's $40 Billion US Export Market Under Cloud: SEBI Analysts Suggest Sectoral Shift, Focus On Safer Domestic Plays

Indian equity markets shrugged off early jitters to climb into a positive territory on Thursday after U.S. President Donald Trump imposed a 25% tariff on Indian goods overnight.

In a Truth Social post late Wednesday, Trump justified the tariffs, blaming India’s import of Russian arms and oil, as well as its high trade barriers and tariffs. Trump also warned of an additional “penalty”.

In an official statement, the Indian government stated that it will "take all steps necessary to secure our national interest" and strive to protect key groups, including small and medium-sized firms, farmers, and entrepreneurs.

Following the announcement, Indian markets reacted with caution, with the Nifty 50 and Sensex declining 0.7% in morning trade, as the rupee too came under pressure. Benchmark indices are currently up 0.2% ahead of their weekly expiry session..

Trade Impact: Sectors To Watch

The tariffs come at a time when India’s exports to the U.S. are at record highs, noted SEBI-registered analyst Pradeep Carpenter.

India maintains a trade surplus with the U.S., exporting more than it imports. Key exports include petroleum products, gems and jewellery, textiles, garments, pharmaceuticals, electronics, and chemicals. Major imports from the U.S. include crude oil, gold, electronics, and industrial machinery.

Given this imbalance, India’s export sectors are especially vulnerable to changes in U.S. trade policy.

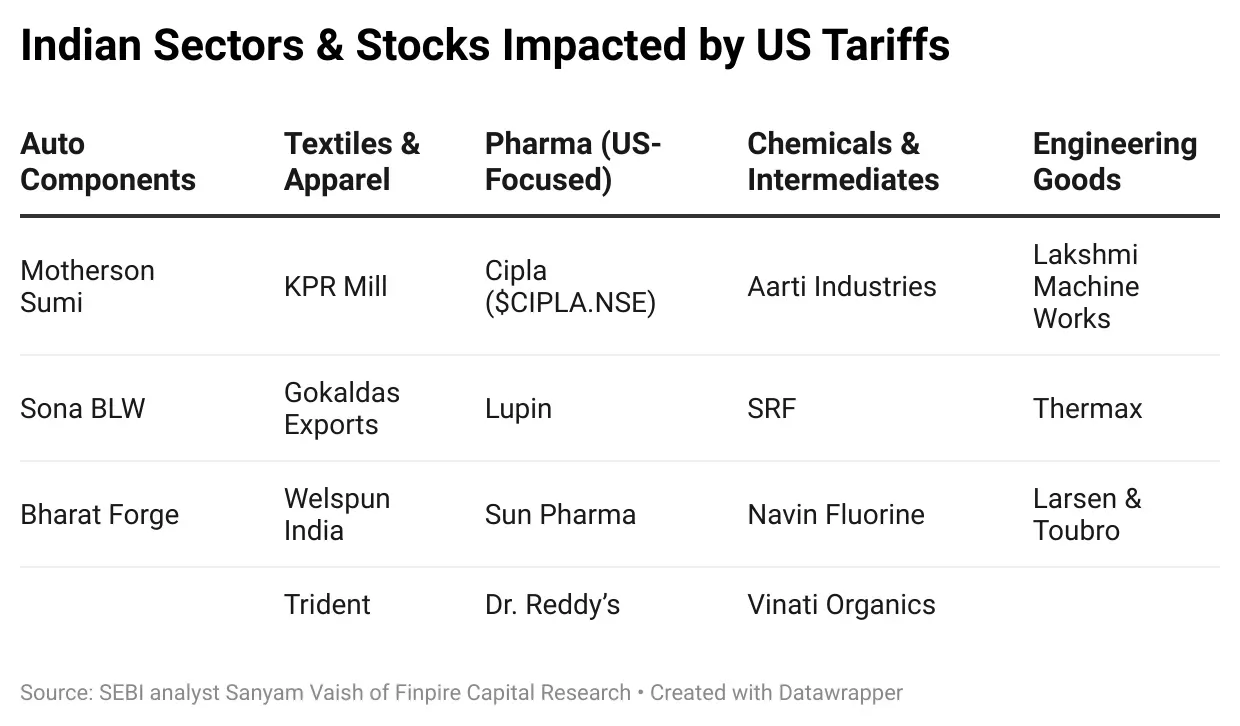

Export-focused sectors such as textiles, jewellery, pharma, auto ancillaries, and ceramics are likely to face margin pressure and order slowdowns, the analyst said.

According to Cashvisory India, these sectors are likely to come under pressure due to their reliance on the US markets.

Smartphones: India has become among the top suppliers to the U.S. in early 2025, with exports crossing $3 billion in January.

Petroleum products: Shipments exceeded $20 billion in 2024.

Gems and jewellery: Particularly diamonds and gold; India exported over $8.5 billion worth of jewellery items in 2024.

Pharmaceuticals: India’s exports to the U.S. have been valued at over $7.5 billion this year.

Textiles and apparel: Ranging from silks to cotton garments, the sector exported over $2.5 billion in goods to the U.S. this year.

The potential for rupee weakness could worsen the situation, reducing dollar inflows. Midcap stocks and globally linked sectors may experience short-term volatility, Carpenter added. Higher tariffs mean reduced pricing competitiveness and could result in earnings downgrades.

How can India Mitigate The Impact?

Carpenter said that the Indian government should look to initiate trade negotiations aimed at securing relief or exemptions for critical sectors. Exports should cater to diverse markets in the EU, the Middle East, and Southeast Asia.

Additionally, bolstering domestic demand through Production Linked Incentive (PLI) schemes and targeted subsidies can help reduce external vulnerabilities, he said.

From companies’ point of view, export-reliant firms should actively explore newer, less tariff-exposed markets and improve cost efficiencies to manage margin pressures.

Carpenter cautioned investors from making premature entries into export-heavy midcaps. He also recommended reducing exposure to U.S. dependent stocks. Sectors with strong domestic operations like banking, FMCG, infrastructure, and railways offer a safer path, he said.

While the new U.S. tariff presents a near-term headwind, it doesn’t alter India’s long-term economic trajectory. Until the policy situation becomes clearer, a cautious and quality-focused investment approach is the best defense. Prioritize structurally strong, domestic-facing names and avoid risky trades in uncertain export sectors.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200767431_jpg_a442265700.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crude_oil_shale_oil_field_resized_jpg_bfab720d5f.webp)