Advertisement|Remove ads.

Veteran Trader Peter Brandt Hints S&P 500 Is Experiencing Exhaustion Gap

- The S&P 500 was down 0.58% to 6,812.22 at the time of writing.

- The index sits comfortably above its 200-day moving average of 6,119.96.

Veteran trader Peter Brandt believes that the S&P 500 index is experiencing an exhaustion gap. In a post on X on Friday, Brandt flagged the exhaustion gap beyond the 6,841.25 level.

An exhaustion gap is a chart pattern that typically forms near the end of a strong trend. It suggests the current momentum may be fading, and a potential reversal or price correction could follow soon.

Notably, from a technical perspective, the S&P 500 sits comfortably above its 200-day moving average of 6,119.96.

S&P 500 Performance

The S&P 500 just notched its sixth consecutive monthly gain, its longest streak since 2021, but many sectors beyond the tech heavyweights are lagging. Analysts argue that this limited breadth could limit further upside and raise concerns about sustainability.

The S&P has gained nearly 18% since Donald Trump’s election victory, fuelled by investor expectations of an economic boom and an AI-tech spending spurt.

Earlier in the day, Goldman Sachs CEO David Solomon told investors at the Global Financial Leaders’ Investment Summit in Hong Kong that markets may see a 10% to 20% pullback over the next one to two years. Morgan Stanley CEO Ted Pick echoed those sentiments, adding that he expects 10% to 15% drawdowns that are not driven by a macro cliff effect.

Meanwhile, uncertainty over the Federal Reserve’s rate-cut outlook also appears to weigh on sentiment. Mixed signals from Fed officials and the suspension of key economic data releases amid the government shutdown are likely to add to investor caution. While the Fed cut rates last week, Chair Jerome Powell indicated it could be the last move this year.

What Are Analysts Saying?

Bank of America’s (BofA) sell-side indicator (SSI) implies an S&P 500 price return of 13% by the end of 2026, which is below this year’s gains so far. However, the indicator remains in neutral territory, still about two percentage points shy of the level that would trigger a formal “Sell” signal.

Goldman Sachs’ David Kostin reiterated his 6,800 year-end target for the S&P 500.

However, some analysts have remained bullish. Fundstrat’s Tom Lee expects the S&P 500 to potentially reach 7,500 by year-end.

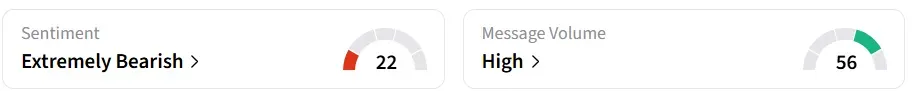

Retail Investor Take

Retail sentiment on Stocktwits turned ‘extremely bearish’ from ‘bearish’ a session earlier.

One user believes that valuations remain stretched, highlighting that most earnings have met or slightly exceeded expectations, but stocks continue to decline.

The S&P 500 has gained 2.27% in October, 3.5% in September, 1.9% in August, and 2.17% in July.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ui_Path_jpg_ca2cd2d4b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)