Advertisement|Remove ads.

Viking Therapeutics Stock Soars To 10-Month High After Canaccord Boost – Retail Traders See It As Next Big Obesity Play

- Canaccord said Viking’s obesity pipeline is worth far more than the current valuation.

- The Metsera outcome renewed investor focus on independent obesity-drug developers, such as Viking.

- Retail traders pointed to potential Phase 3 updates and near-term catalysts.

Viking Therapeutics shares touched a 10-month high on Wednesday after Canaccord Genuity raised its price target to $107 from $106 and kept a ‘Buy’ rating, saying the stock remains “deeply undervalued” given the value now attributed to Metsera and the more advanced nature of Viking’s obesity pipeline.

Canaccord views Viking as “a highly appealing asset in the obesity space” and called it “the leading biotech asset in obesity clinical development.”

Metsera Deal Revives Focus On Independent Players

The upgrade landed days after Novo Nordisk acknowledged losing its $10 billion bidding battle for obesity-drug developer Metsera to Pfizer. The outcome has intensified investor attention on standalone obesity developers, with Viking seen as one of the most strategically valuable remaining targets.

Retail Traders Reignite Deal Buzz

On Stocktwits, where Viking has long been a retail-driven speculation stock, traders revived familiar themes.

Some users floated the idea of a $15 billion to $20 billion acquisition, while others advocated for a UnitedHealth partnership or merger, arguing that it could reduce insurer costs and reshape how small-cap biotech deals are structured. Some traders said Eli Lilly may need to make a defensive offer if an insurer moves first, warning it could otherwise threaten Lilly’s obesity franchise.

Other users argued Viking should stay independent, saying its obesity and MASH programs could support peak sales above $10 billion and a valuation of $50 billion or more. Several traders said the latest rally “feels different,” suggesting momentum may reflect expectations around data, partnership news, or longer-term strategic interest, noting the stock previously surged to around $90 on strong obesity-drug results.

Stocktwits Traders Eye Breakout Toward $43

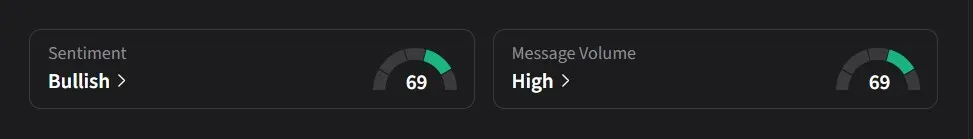

On Stocktwits, retail sentiment for Viking was ‘bullish’ amid ‘high’ message volume.

One user said they expected Viking shares to “lift off to $43” on Thursday, adding that they believed short volume may have been unusually high, with traders “selling small lots back and forth.”

Another user pointed to chatter from patients and social media suggesting that screening for Viking’s Phase 3 obesity trial had wrapped up weeks earlier, saying there was a chance the company could announce completion of enrollment as soon as Thursday or sometime next week.

Viking’s stock has risen 1.3% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)