Advertisement|Remove ads.

Visa Stock Rises Premarket After Q2 Profit Beat: Retail’s Bullish But More Cautious Amid Economic Uncertainty

Visa (V) stock rose 1% in premarket trade on Wednesday after the company topped Wall Street’s estimates for quarterly profit.

The payments firm posted fiscal second-quarter adjusted earnings of $2.76 per share, compared with the average analysts’ estimate of $2.68 per share, according to FinChat data.

Its quarterly revenue of $9.6 billion also beat Wall Street’s expectations of $9.5 billion.

Visa reported a net income of $4.58 billion, or $2.32 per share, for the three months ended March 31, compared with $4.67 billion, or $2.29 per share, a year earlier.

Visa’s total payments volume rose 8% during the second quarter, while cross-border volumes jumped 13%.

“The potential impacts of tariffs have led to higher levels of economic uncertainty. That being said, what we've seen thus far in our results is relative resilience in consumer spending,” CEO Ryan McInerney said.

Rival American Express had also beaten analysts’ quarterly profit expectations earlier in April.

The San Francisco-based firm projected that its entire fiscal year revenue would rise by low double-digit percentage points. It had earlier projected a high single-digit to low double-digit percentage points rise in 2025.

The company also noted a meaningful decline in transactions between Canada and the United States.

Visa forecasted revenue to grow by low single-digit percentage points in the third quarter.

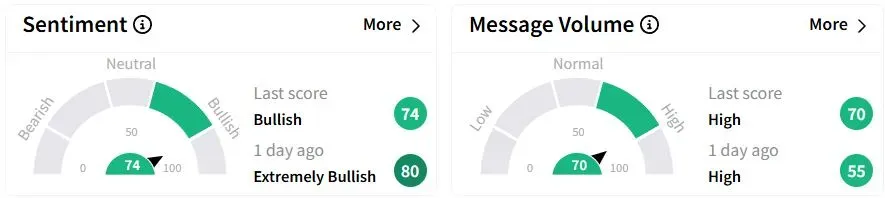

Retail sentiment on Stocktwits moved to ‘bullish’ (74/100) territory from ‘extremely bullish’(80/100) a day ago, while retail chatter remained ‘high.’

One retail trader praised the earnings report and said that the stock should be part of every “high-quality concentrated portfolio.”

Visa stock risen 7.5% year to date (YTD).

Also See: Grab Raises 2025 Forecast After Strong Q1 Revenue, Retail Bulls Elated About Growth

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)