Advertisement|Remove ads.

W.P. Carey On Watch After Upbeat Q4 Revenue: Retail Stays Extremely Bullish

W.P. Carey stock garnered retail attention premarket on Wednesday after its fourth-quarter sales Wall Street estimates.

The real estate investment trust (REIT) reported quarterly revenue of $406.17 million, compared with the average analysts’ estimate of $404.27 million, according to Koyfin data.

However, its net income attributable fell 67.4% to $47 million, compared to the year-ago quarter, due to lower gain on the sale of real estate and a mark-to-market loss recognized on the company’s shares of Lineage of $90.4 million.

Its adjusted funds from operations (AFFO), a metric used to gauge the profitability of REITs, rose to $1.21 per share, compared with $1.19 per share in the year-ago quarter.

The company attributed the rise to outstanding rents collected in connection with a disposition during the current-year period, along with the impact of net investment activity and rent escalations.

The company added that its occupancy stood at 98.6% in 2024, slightly higher than the 98.1% reported last year.

“The fourth quarter concluded a pivotal year for W. P. Carey during which we successfully exited the office sector, setting the foundation for future growth,” said CEO Jason Fox.

W.P. Carey completed investments totaling $841.3 million during the fourth quarter, bringing total investment volume for 2024 to $1.6 billion.

The New York-based company forecast AFFO between $4.82 and $4.92 per share in 2025

“Given the uncertainty in the broader market, however, particularly over the direction of interest rates and other macroeconomic factors, our guidance reflects a measured approach, which we hope proves conservative as the year progresses,” Fox said.

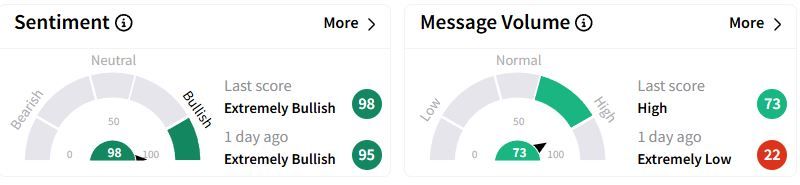

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (98/100) territory than a day ago, while retail chatter jumped to ‘high.’

In January, peer Prologis also topped the Street estimate for quarterly revenue.

Over the past year, W.P. Carey stock has fallen marginally.

Also See: Spirit Airlines Rejects New Merger Offer From Frontier: Retail’s Optimistic About A Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)