Advertisement|Remove ads.

Walmart Could Pull 2025 Outlook Amid Tariffs Fallout, Analyst Says: Retail Turns Slightly Cautious

Wall Street research firm Oppenheimer reportedly said Walmart, Inc. (WMT) could retract its full-year forecasts in light of the new U.S. import tariffs announced last week.

Potential changes to its earnings expectations and comments on the tariffs' impact are key items investors will watch at Walmart's investor day meeting this week.

The supermarket chain will livestream its questions and answers with investors on Tuesday at 9 a.m. ET.

Oppenheimer cut its price target on Walmart's shares to $95 from $110 and lowered its expectations for the company's earnings in quarters two through four due to the tariffs, according to Investing.com.

The brokerage, which maintained an 'Outperform' rating on the stock, said Walmart's first-quarter earnings per share (EPS) guidance is achievable but with limited scope for outperformance.

It also expects consumers to increase their purchases in the short term to preempt tariff-driven price hikes. This could help Walmart mitigate some recent weakness in discretionary spending categories.

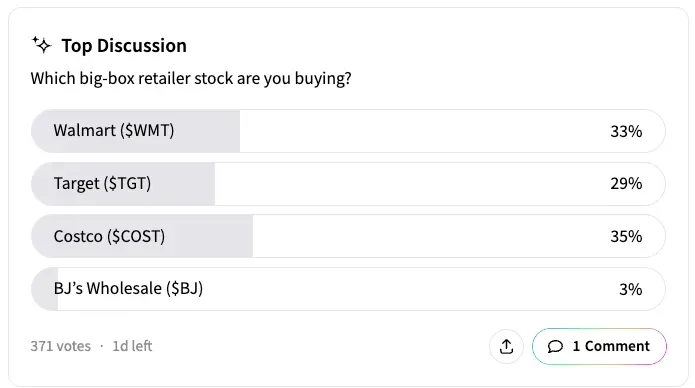

In an ongoing Stocktwits poll, Walmart was neck and neck with Costco (COST) as investors' preferred big-box retailer stock.

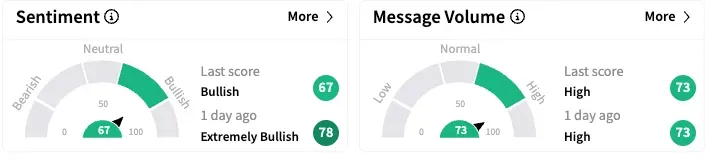

Retail sentiment on the platform, however, dropped to 'bullish' from 'extremely bullish', while the message volume remained high.

Users flagged that China would likely announce reciprocal tariffs soon, which might add further selling pressure on Walmart.

The company is one of the worst hit consumer stocks amid Donald Trump's tariffs war, with shares falling about 20% from a recent peak in February.

So far this year, WMT shares are down 7.2%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)