Advertisement|Remove ads.

Walmart Stock Slides As Weak Full-Year Outlook Dulls Q4 Beat: Retail Stays Upbeat Despite CFO Flagging Trump Tariff Risks

Shares of Walmart Inc. (WMT) slipped more than 6% on Thursday after the retailer gave lower-than-estimated fiscal Q1 and 2026 guidance despite a Q4 earnings beat, with retail sentiment staying upbeat.

Walmart’s Q4 earnings per share came in at $0.66, surpassing expectations of $0.65. While revenue stood at $180.55 billion, rising 4.1%, and beating estimates of $179 billion. In constant currency terms, its revenue went up 5% and its adjusted operating income rose over 9%.

Its Q4 U.S. comp sales grew 4.6% with positive growth in general merchandise, the company said.

Walmart’s Global eCommerce sales grew 16%, led by store-fulfilled pickup and delivery and the U.S. marketplace. The marketplace segment grew 34% in the U.S., strengthened by a broader assortment of the general merchandise brands and items customers want.

"Our team finished the year with another quarter of strong results. We have momentum driven by our low prices, a growing assortment, and an eCommerce business driven by faster delivery times,” said Walmart president and CEO Doug McMillon. “We're gaining market share, our top line is healthy, and we're in great shape with inventory.”

However, its guidance for FY26 of net sales growth of 3% to 4% fell below Wall Street estimates of 4% growth. For the full year, adjusted earnings are expected between $2.50 and $2.60 per share, below the consensus estimate of $2.76.

For Q1, the company expects adjusted earnings per share between $0.57 and $0.58, which will be below the consensus estimates of $0.65. Net sales are expected to grow 3% to 4%

in constant currency, with adjusted operating income growth between 0.5% and 2%.

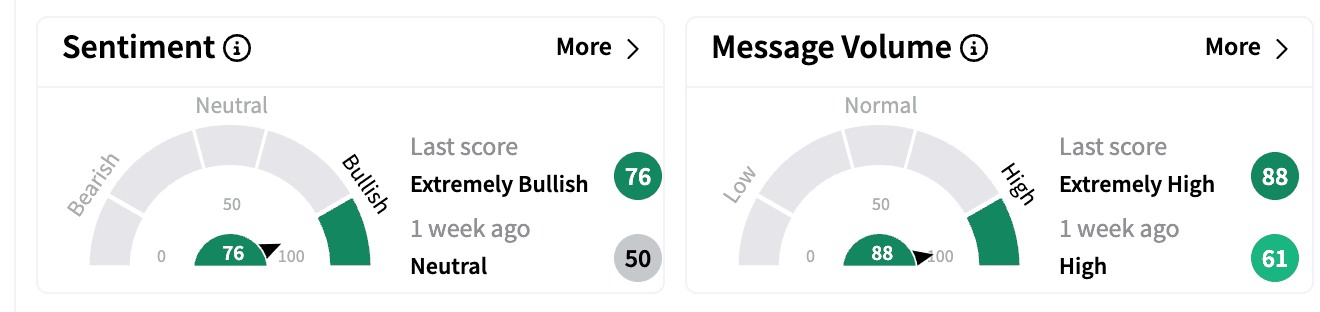

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘neutral’ a week ago. Message volume jumped to ‘extremely high’ from ‘high.’

One bullish commenter was optimistic about the stock despite the conservative guidance.

Walmart CFO John David Rainey told CNBC that the company will not be entirely shielded from trade duties under the Trump administration, even though most of the company’s products come from the U.S. He added that the guidance did not account for tariffs as it was still uncertain if they would take effect next month.

Walmart also approved an annual cash dividend for fiscal year 2026 of $0.94 per share, which will be paid in four quarterly installments of $23.5 per share.

Stifel analyst Mark Astrachan raised the price target on Walmart to $99 from $94 with a ‘Hold’ rating based on its analysis that Walmart is continuing to grow operating profit ahead of sales while maintaining share gains, Fly.com reported. According to the firm, its first-time FY26 guidance was "largely conservative, consistent with initial guides in recent years."

Walmart stock is up 7.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)