Advertisement|Remove ads.

Webull Stock Sees More Than 100% Jump In Retail Chatter After Swing To Q1 Profit: Retail Shrugs Off After-Hours Decline

Webull (BULL) stock drew heavy retail chatter on Thursday after the company swung to a first-quarter profit.

The online trading platform reported a net income of $12.9 million, compared to a loss of $12.6 million for the quarter ended March 31.

Its first-quarter revenue jumped 32% year-over-year to $117.4 million.

This was the first earnings report since the company was listed on Nasdaq in April through a merger with a special-purpose acquisition company.

Webull said its customer assets rose 45% to $12.6 billion, driven by strong net deposits, which jumped 66%.

The company said its registered users jumped 17% to 24.1 million users at the end of the first quarter, while its equities notional volume grew to $128 billion.

"We continue to see strong account growth as our global teams execute on our strategy in 2025 to address and meet the long-term investing needs of individual investors around the world," Chief Financial Officer H.C. Wang said.

However, the stock was down 3.2% in extended trading. As of Thursday’s close, its market valuation was $6.2 billion.

Earlier in May, the company signed an agreement with BlackRock to deliver automated wealth management tools to its U.S.-based customers.

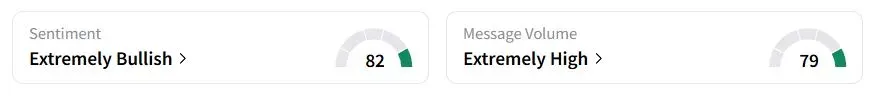

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (82/100) territory, while retail chatter was ‘extremely high.’

“Think we are green by open,” one retail trader said after saying that earnings were “really good” compared to expectations.

Another user said the after-hours dip was a “common overreaction.”

Webull stock has gained 16.2% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)