Advertisement|Remove ads.

WeightWatchers Stock Rockets After Partnership For Eli Lilly's Zepbound Drug: Retail Investors Very Optimistic

Shares of WW International Inc. (WW), better known as WeightWatchers, swung wildly again on Tuesday after announcing a new tie-up to tap into the booming weight-loss drug trend.

The company’s stock doubled intraday before ending the session 77% higher. It jumped over 9% in extended trading.

WW said it had integrated Eli Lilly's (LLY) LillyDirect pharmacy provider, Gifthealth, into its platform to streamline access to the FDA-approved weight-loss drug, Zepbound.

WeightWatchers said that eligible self-pay patients without insurance can now access prescriptions for Zepbound in single-dose vial form through the company's app.

According to the company, demand for Zepbound has surged among WeightWatchers Clinic members, with prescriptions for the vial version more than doubling in recent months.

Currently, 33% of WeightWatchers' clinic patients use Zepbound as part of their weight management regimen.

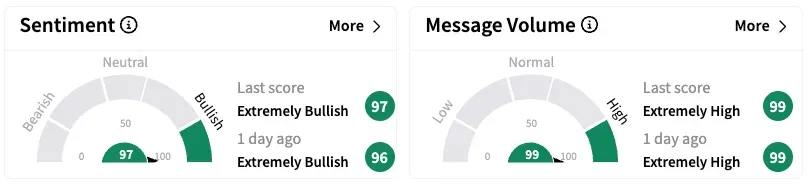

On Stocktwits, retail sentiment for the company climbed higher within the 'extremely bullish' zone.

The development comes amid bankruptcy reports and days after an activist investor disclosed its interest in the firm.

Earlier this month, reports emerged that WW was considering filing for Chapter 11, leading to its shares plummeting 62% on a single day.

On Friday, Galloway Capital Partners disclosed it owns a 2.87% stake in the company and urged it not to consider bankruptcy, leading to a whopping 168% spike in share price.

While WeightWatchers hasn't commented on a potential bankruptcy plan, its business continues to be under pressure.

The company's revenue has fallen 11% to 14% in each of the last three years, and early this year, S&P Global Ratings downgraded its rating on the company's debt.

Shares of WeightWatchers are down 42.4% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)