Advertisement|Remove ads.

S&P 500 Lags Emerging Markets In 2025, But Wells Fargo Says It’s Time To Reenter US Equities — Retail Traders Agree

U.S. equities are staging a recovery rally in 2025, buoyed by easing trade tensions after the shock dealt by President Donald Trump’s sweeping tariff blitz last month.

As of the last close, the S&P 500 is up about 1% for the year, rebounding sharply after briefly dipping into bear market territory in early April.

However, emerging markets have shown more promise. The MSCI Emerging Markets Index — which captures large and mid-cap representation across 24 emerging markets (EM) countries — is up over 10% year-to-date, fueled by optimism over global growth and a weakening U.S. dollar.

Still, Wells Fargo investment strategist Austin Pickle thinks the tide may be turning. In a note this week, he argued that investors are too optimistic about EM performance, and that U.S. stocks, particularly large- and mid-cap equities, are poised to outperform in the second half of 2025.

“The EM sentiment pendulum has swung too far positive,” Pickle said. “The global economic rebound we expect later in 2025 and the eventual resolution of many trade-related concerns will push EM prices higher, but those returns will lag U.S. markets.”

He also cited increased fiscal spending in Europe, the stability of developed markets, and a potential rebound in the dollar (which has fallen over 10% from its January peak) among reasons to overweight advanced-economy equities.

Bloomberg noted that his view contrasts with calls from Morgan Stanley, Bank of America, and JPMorgan, which are more favorable toward developing markets.

However, Pickle is not alone in his U.S.-leaning stance. BlackRock’s Rick Rieder recently reaffirmed his bullish view of America’s economy, despite the Treasury market volatility following Moody’s downgrade of the U.S. credit rating.

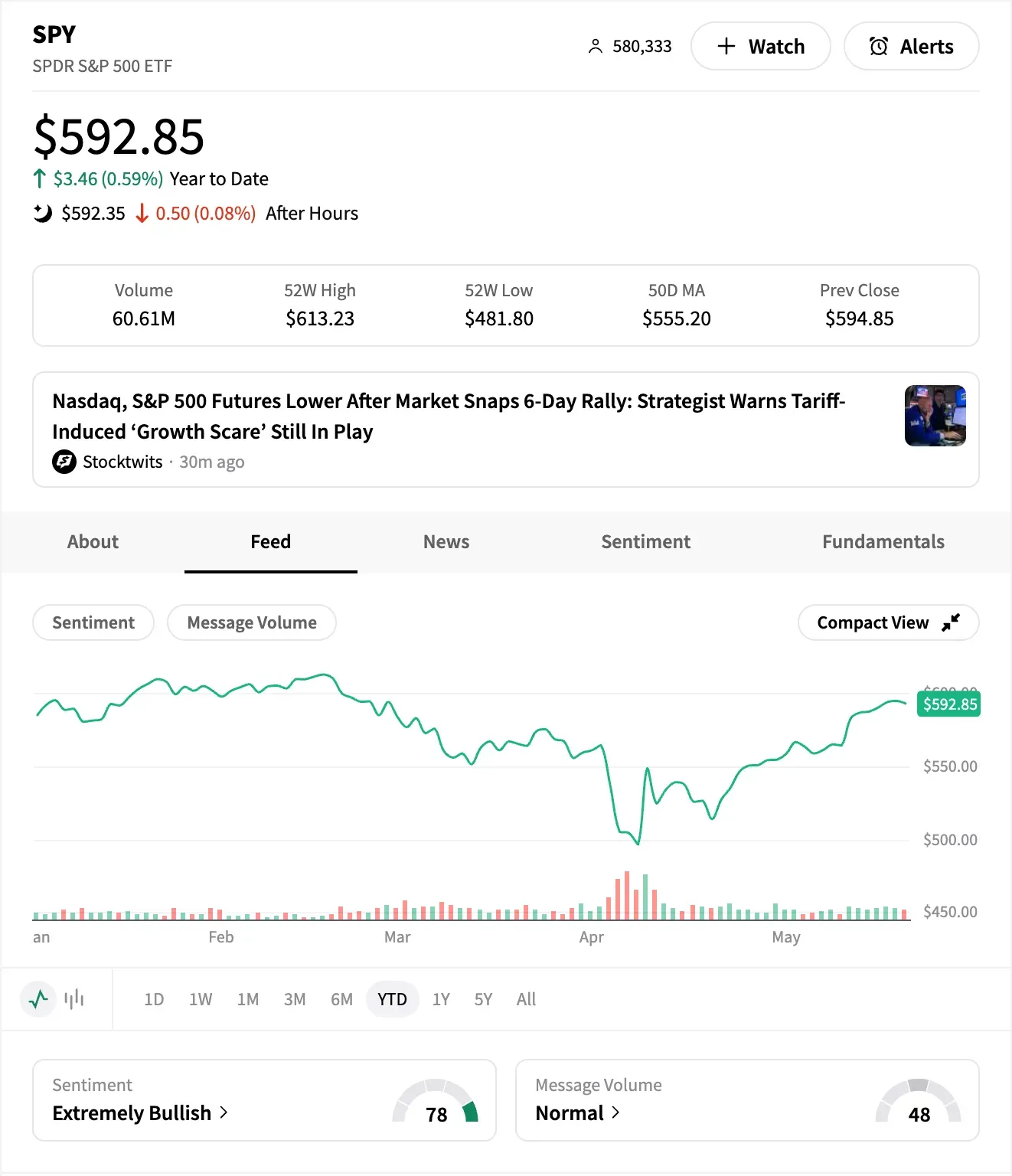

Retail sentiment is shifting in the same direction. On Stocktwits, sentiment for the SPDR S&P 500 ETF (SPY) — which tracks the benchmark index's performance — remains ‘extremely bullish’ as it did six months ago.

Over the past three months, retail following for SPY has risen by more than 4%, and message volume has jumped 18%.

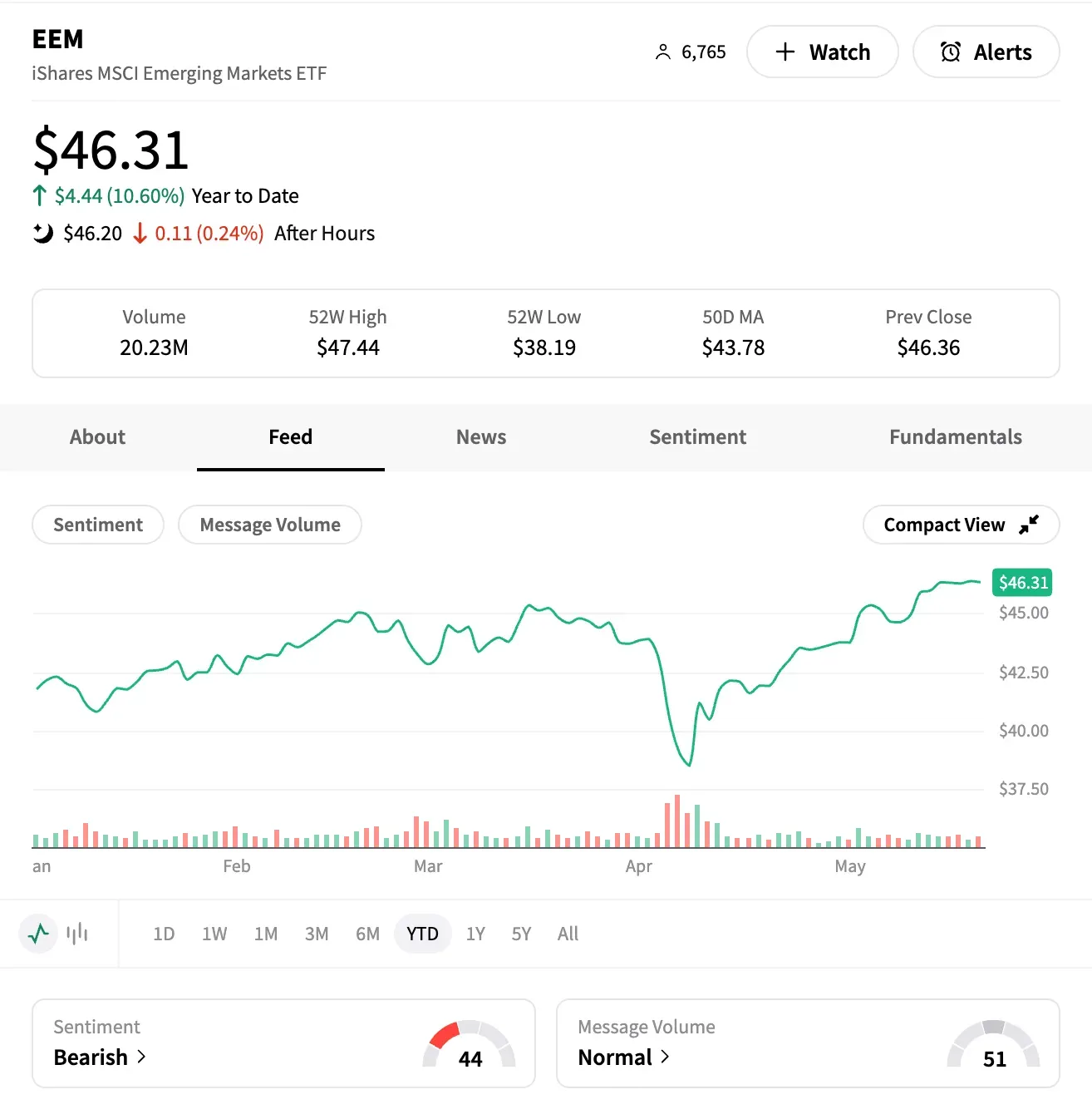

Meanwhile, sentiment for the iShares MSCI Emerging Markets ETF (EEM) has changed from ‘bullish’ to ‘bearish’ in the last six months.

Its Stocktwits following is up only 0.6% in the past three months, while message volume has barely moved, reflecting growing caution among retail traders.

Recent polls on the platform also indicate renewed optimism toward U.S. markets and economic health. Most retail traders believe America will not enter a recession in 2025, and a majority want to buy more or hold their positions following the recent rebound.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)