Advertisement|Remove ads.

Cigna Stock Slides 8% On Thursday But Wells Fargo Analyst Is Surprised: Here’s What Happened

Wells Fargo analyst Stephen Baxter on Thursday expressed surprise at The Cigna Group (CI) stock trading in the red, while noting that the company’s second-quarter earnings appear to be “solid.”

Wells Fargo has an ‘Equal Weight’ rating on the shares with a price target of $341, representing an upside of about 14.5% from the stock’s closing price on Wednesday.

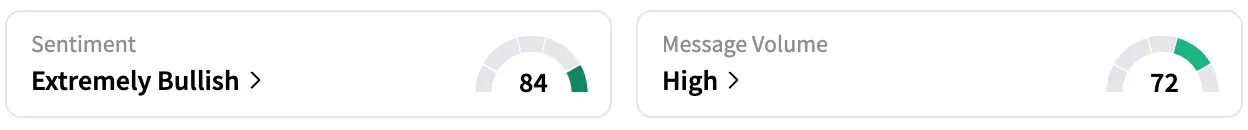

On Stocktwits, retail sentiment around Cigna jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours, while message volume stayed at ‘high’ levels.

A Stocktwits user echoed the analyst’s sentiment and opined that the stock drop doesn’t align with the upbeat Q2 earnings.

Another user opined that the stock is supposed to be above $300.

Cigna on Thursday reported second-quarter total revenue of $67.2 billion, marking a growth of 11%, and above an analyst estimate of $62.61 billion, according to data from Fiscal AI. The growth was primarily driven by the company’s Evernorth Health Services segment, which includes its pharmacy benefit management business.

Evernorth segment reported a revenue of $57.83 billion in the quarter, up from the $49.55 billion reported in the second quarter of 2024, marking an increase of 17%.

The company's adjusted income from operations came in at $7.20 per share, upping an analyst estimate of $7.15 per share.

The health insurer's medical cost ratio in the quarter was 83.2%, compared to 82.3% in the second quarter of 2024, primarily due to expected higher stop loss medical costs, the company said. Medical cost ratio refers to the percentage of premiums spent on medical costs.

The company also reaffirmed its full-year outlook for adjusted income from operations of at least $29.60 per share and a medical cost ratio between 83.2% and 84.2%.

CI stock is down by about 1% this year and by 22% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)