Advertisement|Remove ads.

This Auto Giant Bagged £1 Billion Export Development Guarantee From UK, Investors Expect Stock To Breakout: More Details Inside

British government agency UK Export Finance (UKEF) on Thursday provided a £1 billion ($1.32 billion) export development guarantee to Ford U.K., a unit of U.S. automaker Ford Motor Co. (F).

UKEF’s Export Development Guarantee (EDG) helps companies that export from, or plan to export from the U.K., access high-value loan facilities for general working capital or capital expenditure purposes.

The new loan will help Ford continue its global transformation, engineering and manufacturing of smart, connected, and electrified vehicles for customers around the world, the agency said, while adding that it is guaranteeing 80% of the £1 billion loan provided by Citi and a syndicate of lenders.

This is the third export development guarantee awarded by UKEF to Ford, taking total financing to almost £2.4 billion since 2020, of which £1.9 billion is guaranteed by UKEF.

Ford operates various sites in Britain, including a research and development (R&D) centre based in Essex. It directly employs more than 5,500 workers across the country. The U.K. and the U.S. recently entered into a trade deal, reducing car export tariffs for carmakers exporting to the U.S. from 27.5% to 10%.

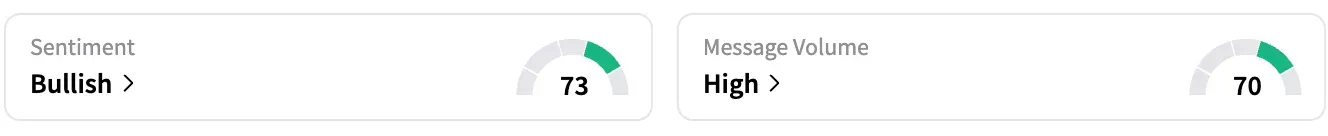

On Stocktwits, retail sentiment around Ford is trending in the ‘bullish’ territory over the past 24 hours, while message volume jumped from ‘low’ to ‘high’ levels.

According to Stocktwits data, retail chatter around the stock jumped 947% over the past 24 hours.

A Stocktwits user opined that the stock is a ‘Buy’.

Another user believes the shares are “about to break out.”

Ford on Wednesday reinstated its 2025 guidance, which was suspended in May due to tariff uncertainty.

The firm now expects full-year adjusted earnings before interest and taxes (EBIT) of $6.5 billion to $7.5 billion, down from its February projection of $7 billion to $8.5 billion. The updated outlook includes the $2 billion tariff drag, which is composed of $3 billion in gross impacts, partially offset by $1 billion in recovery actions.

The company’s second-quarter adjusted earnings per share fell 21% to $0.37 but still beat Wall Street expectations.

F stock is up by over 11% this year and by about 1% over the past 12 months.

Read also: Stellantis Stock Slides Premarket As Auto Giant’s Reinstated Guidance Leaves Investors Unimpressed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)