Advertisement|Remove ads.

Wells Fargo Stock Gains After Fed Lifts Asset Cap — Retail’s Elated

Wells Fargo (WFC) stock rose 3% in extended trading on Tuesday after the Federal Reserve lifted an asset cap imposed on the lender after seven years of punishment following a fake accounts scandal.

The Fed's move would help Wells Fargo, the fourth-largest U.S. bank, close the gap with its peers. It would allow Wells Fargo to issue more loans, boost its deal-making business, and increase credit card offerings, among other benefits.

The asset cap, imposed in 2018, was the regulator's first such punishment against a large U.S. bank. Wells Fargo employees had opened thousands of credit cards and deposit accounts without customers’ consent.

Later, Wells Fargo informed that about 3.5 million unauthorized bank accounts may have been opened between 2009 and 2016.

“The removal of the growth restriction reflects the substantial progress the bank has made in addressing its deficiencies and that the bank has fulfilled the conditions required for removal of the growth restriction,” the Fed said in a statement.

However, according to the Fed, the other provisions of the 2018 consent order will remain in place until the lender satisfies all the conditions required for termination.

The removal of the asset cap marked a significant victory for CEO Charlie Scharf, who had been roped in from BNY to fix the bank’s compliance issues in 2019 after the scandal led to the ouster of two previous CEOs.

Under Scharf, who has significantly ramped up the bank’s regulatory oversight, Wells Fargo has closed thirteen consent orders since 2019.

“The Federal Reserve’s decision to lift the asset cap marks a pivotal milestone in our journey to transform Wells Fargo. We are a different and far stronger company today because of the work we’ve done,” CEO Charlie Scharf said.

The bank would also provide its full-time employees with a special payment of $2,000 to mark the occasion.

"We believe that the most significant benefit of the removal of the asset cap will be on the deposit side as WFC management has noted there have been commercial deposits they’ve had to turn away due to the asset cap," Citigroup analyst Keith Horowitz said, according to a Reuters report.

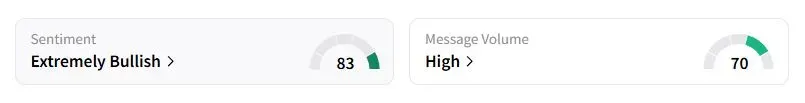

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (83/100) territory, while retail chatter was ‘high.’

“Tune in next week for the next episode,” one retail trader said after speculating about potential dividends and buybacks.

Another user said that the decision came sooner than expected.

Wells Fargo stock has gained 7.3% this year.

Also See: SpaceX To Record $15.5B In Revenue This Year, Says CEO Elon Musk

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)