Advertisement|Remove ads.

WeShop Stock Gains Over 6-Fold, Days After Direct Listing: Retail Ecstatic

- Shares of UK-based WeShop Holdings rose 506% on Wednesday, before paring some of those gains in the after-market session.

- Retail investors, however, have noticed the stock’s low free float.

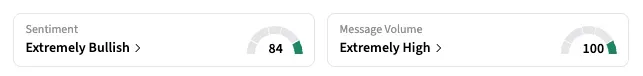

- The WSHP ticker trended on Stocktwits with an ‘extremely bullish’ sentiment reading.

WeShop Holdings Ltd.’s shares gained over sixfold on Wednesday and drew an incredible buzz on Stocktwits, days after its direct listing.

Shares of the UK-based social commerce company closed 506% higher at $200. The stock closed at $30.21 on Friday, its first day of trading on the Nasdaq Capital Market, which is meant for smaller companies. The stock, however, pared some gains in the after-market session and declined 38%.

On Stocktwits, the retail sentiment for WSHP was ‘extremely bullish’ (87/100), with the ticker trending at the number five spot with ‘extremely high’ (100/100) message volume as of late Wednesday.

“$WSHP The current float must be very tiny,” said a user. “I am not sure when the rest of the float will become available. Till then, this will be very volatile.”

According to Stocktwits data, the stock’s trading volume surged to 268,522. In a separate post, the user estimated the free float – the number of company shares that are available for trading – between 160,000 and 490,000.

WeShop has a unique model that allows users to earn shares of the company. Through its ShareBack program, users earn WePoints for buying or referring friends, and with those WePoints can be converted into actual shares.

The company has set aside over 50% of its shares in a trust to be distributed to its shoppers. The company has about 34 million outstanding shares, according to Koyfin.

WeShop’s net revenue decreased 11% year over year to 1.3 million pounds ($1.7 million) in 2024, while net losses narrowed to 12.1 million pounds from 61.4 million pounds, according to the company’s F-1 filing. It reported total assets of 14 million pounds as of December 2024.

For casual users, WeShop is a platform to shop from hundreds of major retailers while sharing, discovering, and recommending products socially. The company intends to launch its app in the U.S. soon.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Trump Could Sign Executive Order To Regulate AI On Friday – What’s In The Bag?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)