Advertisement|Remove ads.

Western Alliance Bancorp Stock Turns Retail Traders Extremely Bullish After Q3 Print

- The lender’s net income rose to $260.5 million, or $2.28 per share, for the three months ended Sept. 30, compared with $199.8 million, or $1.80 per share, a year earlier.

- "Relative to a low bar, we think both better-than-expected credit results and the sizable deposit growth/pre-provision net revenue beat will lead to outperformance.” - Stephens.

- The company said that its total criticized assets declined $284 million quarterly.

Western Alliance Bancorp (WAL) stock is poised to rise when the market opens on Wednesday, following the lender's posting of a rise in quarterly earnings amid concerns over credit quality.

The lender’s net income rose to $260.5 million, or $2.28 per share, for the three months ended Sept. 30, compared with $199.8 million, or $1.80 per share, a year earlier. Its revenue rose 14.2% to $938.2 million, topping Wall Street’s estimates of $890.35 million, according to Fiscal.ai data. The stock gained 2.4% in extended trading on Tuesday.

What Drove WAL Earnings Higher?

The lender’s net interest income totaled $750.4 million in the third quarter, a 7.7% increase compared to the same period last year. Its total assets increased to $91.0 billion at Sept. 30, from $80.1 billion a year ago. The bank attributed the increase in total assets to increases in loans held for investment (HFI) and loans held for sale (HFS), cash, and investment securities. Its total deposits rose 13.5% compared to year-ago levels.

"Relative to a low bar, we think both better-than-expected credit results and the sizable deposit growth/pre-provision net revenue beat will lead to outperformance,” in Wednesday’s trading, Stephens analysts wrote in a note, according to a Reuters News report.

What Is Retail Thinking?

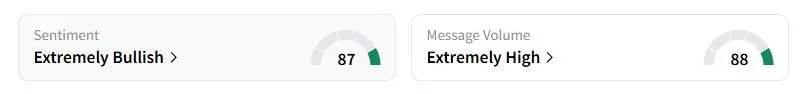

Retail sentiment on Stocktwits about Western Alliance was in the ‘extremely bullish’ territory at the time of writing.

“This quarter is the best quarter in a while,” one user wrote.

What Was The Impact Of Cantor-linked Charge?

Western Alliance and other regional banking peers’ stocks were hit last week due to growing concerns over the health of the financial sector following a series of defaults in autos and subprime loan categories.

The lender said that last week it sued a borrower named Cantor Group for failing to provide collateral on loans issued to it. “Related to the Cantor Group V loan, although the most recent appraisals indicate sufficient collateral coverage, our reserve methodology for a $98 million non-accrual loan resulted in a reserve of $30 million,” CEO Kenneth Vecchione said.

The company reported a $284 million decline in its total criticized assets on a quarterly basis. Additionally, the nonperforming loans and repossessed assets to total assets ratio decreased by two basis points to 0.72%, while net loan chargeoffs to average loans remained unchanged from last quarter at 0.22%.

Western Alliance stock has fallen 9.5% this year.

Also See: Why Is AST Spacemobile Stock Sliding Over 6% Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)