Advertisement|Remove ads.

Which Stock Should Be Added To S&P 500 Next? Stocktwits Users Favor Robinhood Over Reddit, AppLovin, Carvana

Datadog (DDOG) will be the next company to be added to the broader S&P 500 Index following Juniper Network’s acquisition by Hewlett-Packard Enterprises (HPE).

The announcement from index compiler S&P Dow Jones regarding the inclusion, which is said to take effect before the market opens on July 9, sent Datadog stock up by about 15% on Thursday.

The rally was also partly aided by the broader market strength seen in the session following a stronger-than-expected June non-farm payrolls report.

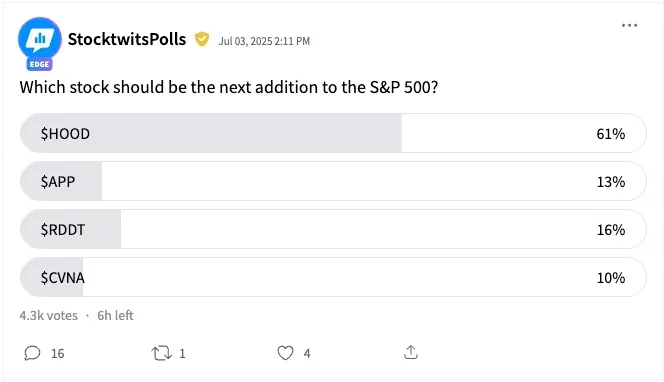

Against the backdrop, Stocktwits asked its users, “Which stock should be the next addition to the S&P 500?” The ongoing poll has received responses from 4,300 users so far.

The overwhelming preference of the retail community was Robinhood Markets, Inc. (HOOD) (61%). The retail trading app offers commission-free trading for its users and allows trading in a diverse range of financial instruments, including stocks, exchange-traded funds (ETFs), and cryptocurrencies.

Menlo Park, California-based Robinhood has seen its share surge by over 150% so far this year, benefiting from new features, strong operational metrics, and the prospects of inorganic growth.

Robinhood stock breached the $100 psychological barrier on an intraday basis for the first time last Wednesday but has since then come off this mark.

The next favorite among Stocktwits users was the community-based social media platform Reddit, Inc. (RDDT) (16%), followed by AppLovin Corp. (APP) (13%) and Tempe. Arizona-based used car retailer Carvana, Inc. (CVNA) (10%).

Reddit stock has had a volatile year, trading in the $79.75-$230.41 range. The stock is down about 4%, underperforming the broader market.

AppLovin stock is up about 6% despite the App marketing platform coming under attack from short sellers for misrepresenting key operational metrics.

Meanwhile, Carvana stock, although considered a speculative bet, has added over 70% this year. The positive sentiment can be traced back to a solid first-quarter report it released in early May.

The S&P 500 Index, a market-cap-weighted index, is considered the best single measure of large-cap U.S. equities, comprising 500 leading companies that collectively cover approximately 80% of the total market capitalization. The eligibility criteria for addition to the index include a market cap of $22.7 billion or more.

Index inclusion typically generates positive sentiment toward the stock, as investors view it as a validation of the company’s credentials as a stable and growing entity. Also, funds tracking a particular index would load up on the stock to align their portfolio weighting with that of the index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Sandisk Gets Bullish Initiation From Jefferies, But Retail Sentiment Lags

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)