Advertisement|Remove ads.

Will Warner Bros Discovery Be Acquired By Paramount Or Netflix? Here's What Polymarket Bettors Think

- Paramount offered $30 per share in cash, and the company stated that the proposed transaction is for the entirety of WBD, including the Global Networks segment.

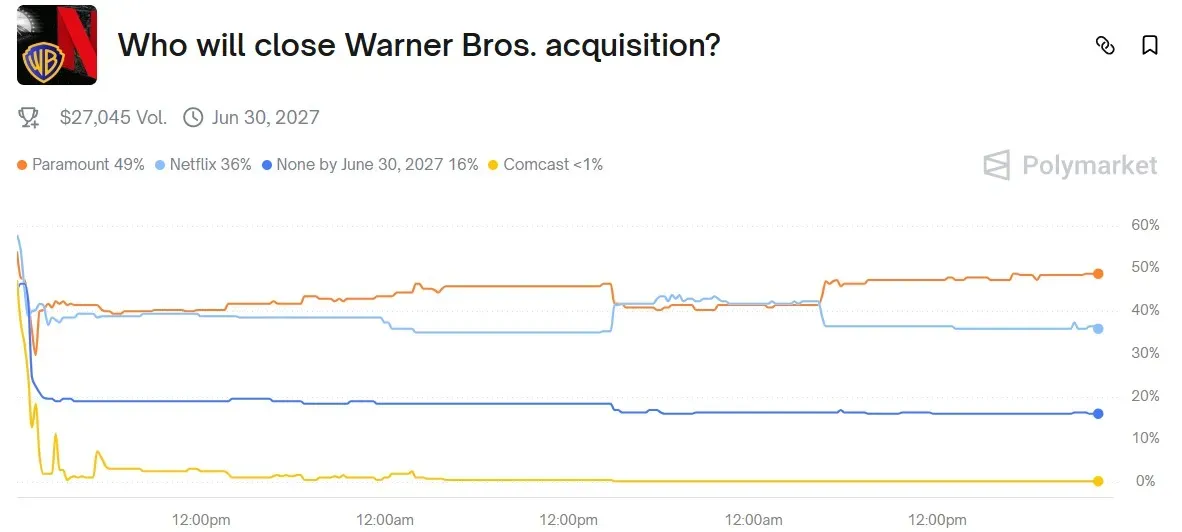

- Data from Polymarket show that 49% of bettors expect Paramount to emerge as the winner, with bets totaling $7,507 on the company.

- Only 36% of the bettors expect Netflix to emerge as the winner, but the bets are slightly higher, at $10,948.

The race to acquire Warner Bros. Discovery (WBD) is gathering steam, with Paramount Skydance Corp. (PSKY) having launched a hostile bid to take over the company, days after Netflix Inc. (NFLX) was announced as the winner.

Paramount offered to acquire Warner Bros. Discovery in an all-cash deal that values the latter at $108.4 billion. The company said its proposal gives WBD shareholders an extra $18 billion when compared to the Netflix bid.

Paramount offered $30 per share in cash, and the company stated that the proposed transaction is for the entirety of WBD, including the Global Networks segment.

While it’s not clear who will emerge as the winner, the betting markets are already putting their money on the one they think will be the winning horse.

What Are Prediction Markets Showing?

Data from Polymarket show that 49% of bettors expect Paramount to emerge as the winner, with bets totaling $7,507 on the company.

Only 36% of the bettors expect Netflix to emerge as the winner, but the bets are slightly higher, at $10,948.

Overall, there are bets totaling $27,045 on Polymarket predicting the winner of the Warner Bros. Discovery deal.

Paramount Skydance shares were down nearly 1.5% in Thursday morning’s trade, while Warner Bros. Discovery shares were down nearly 0.4%. Retail sentiment on Stocktwits around both companies trended in the ‘extremely bullish’ territory at the time of writing.

Netflix shares were up more than 2% at the time of writing, with retail sentiment on Stocktwits around the company trending in the ‘extremely bullish’ territory.

Countering Netflix

Paramount called its all-cash offer for all of Warner Bros. Discovery’s assets “superior” to Netflix’s, which was approved last week.

“Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion,” said Paramount CEO David Ellison.

Paramount has also lined up $54 billion in debt to fund its acquisition of WBD. The company stated in its announcement that Bank of America, Citigroup, and Apollo Global Management are providing the debt commitment.

Netflix had lined up $59 billion to fund its deal, with commitments from Wells Fargo, BNP Paribas, and HSBC.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)