Advertisement|Remove ads.

Why Did Intel Stock Jump Over 3% After-Hours?

- Intel stock snaps two-day losing streak, rising by over 3% on Tuesday.

- Shares advanced further in the after-market session, amid speculation that Nvidia might use Intel manufacturing for its next-gen AI and GPU platform.

- Stocktwits sentiment has reamined ‘extremely bullish’ over the past few days.

Intel Corp. stock broke its two-day losing streak, rising 3.3% on Tuesday, offering investors some respite amid a polarising debate over the future of the legacy chipmaker.

Shares advanced by a similar magnitude in the after-market session as well, without a clear catalyst, further piquing interest. Some users on Stocktwits speculated whether Intel has a major deal or announcement in the works, which would boost the sentiment after its fourth-quarter report last week largely disappointed.

“$INTC what if I told you there was more news?” remarked a user.

Intel said it had not bagged a major customer for its foundry – a fledgling business unit that the company has been trying to turn around by reorganizing and bringing in external customers.

Now, rumours are swirling that chip giant Nvidia might use Intel’s factories for part of the production related to Nvidia’s next-gen Feynman architecture. The AI and GPU platform is likely to be announced in 2028 and would succeed the recently announced Rubin system.

Shay Boloor, a market strategist at Futurum Equities, said in an X post that Intel would be part of Nvidia’s multi-sourcing plan. Neither Nvidia nor Intel has publicly confirmed this news.

Its main manufacturing partner, Taiwan Semiconductor Manufacturing, would build the main GPU die, while Intel could handle the input/output (I/O) die and Embedded Multi-Die Interconnect Bridge (EMIB) packaging, Boloor said, without discussing the source of the information.

To be sure, Nvidia recently completed a previously announced $5 billion investment in Intel as part of a deal to also co-develop chips.

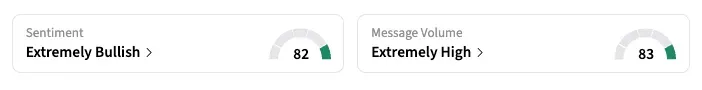

On Stocktwits, retail sentiment on INTC has stayed in the ‘extremely bullish’ zone since last week’s earnings, while message volume has remained ‘extremely high’ over the past two days.

Investors were disappointed in Intel’s guidance and the lack of progress in its foundry business. However, retail investors are increasingly optimistic, citing several indicators that support an upbeat long-term outlook.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Corning Stock Posts Best Day In Two Decades After $6B Meta Deal

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)