Advertisement|Remove ads.

Why Did KEYS Stock Surge 14% In Premarket Today?

- Keysight posted a 10% increase in Q4 revenue to $1.42 billion, above Stocktwits’ estimate of $1.38 billion.

- Keysight expects Q1FY26 revenue to range between $1.53 billion and $1.55 billion, 18% - 20% above the Q1 FY25 revenue.

- Keysight’s board of directors also approved the buyback of up to $1.5 billion of common stock.

Shares of Keysight Technologies Inc. (KEYS) jumped nearly 14% in premarket trading on Tuesday after several brokerages raised their price targets. The upgrades followed the company’s stronger-than-expected fourth quarter results and a solid fiscal 2025 outlook.

Keysight’s board of directors also approved the buyback of up to $1.5 billion of common stock.

Earnings Print

The company delivered a solid fourth quarter, posting a 10% increase in revenue to $1.42 billion, above Stocktwits’ estimate of $1.38 billion. Its non-GAAP earnings also improved to $331 million, or $1.91 per share, exceeding estimates of $1.82 per share.

For the full fiscal year 2025, revenue rose 8% to $5.37 billion, beating the $5.33 billion forecast, while earnings per share of $7.16 came in above Stocktwits’ $7.07 guidance.

Keysight expects first-quarter fiscal 2026 revenue to range between $1.53 billion and $1.55 billion, 18% - 20% above the Q1 FY2025 revenue of $1.30 billion. Non-GAAP EPS is projected to be between $1.95 and $2.01, versus $1.82 in the previous corresponding period.

Brokerage Upgrades

Barclays raised Keysight’s price target to $232 from $195 and maintained an ‘overweight’ rating, according to TheFly. Barclays said that despite concerns around wireless, Keysight sees another year of growth in fiscal 2026.

Wells Fargo raised the price target to $225 from $190 and kept an ‘overweight’ rating. Wells Fargo cites an increased upside EPS thesis to +$10 per share. The brokerage firm also points out the company’s strong acceleration in order growth.

How Did Stocktwits Users React?

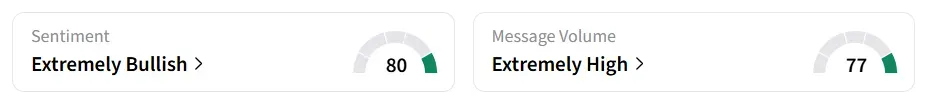

Retail sentiment on Stocktwits shifted to ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes.

One user sees bullish chart patterns.

Keysight stock is around $8 off its all-time high of $209.08. Year-to-date, the stock has gained around 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)