Advertisement|Remove ads.

Why Did MakeMyTrip Stock Fall Today?

- Citi cut MakeMyTrip’s price target to $96 from $108, while maintaining a ‘Buy’ rating on the shares after its earnings results.

- Morgan Stanley lowered its price target on the company to $106 from $113 while maintaining an ‘Overweight’ rating on the shares.

- The company missed revenue estimates, reporting quarterly revenue of $295.7 billion, compared to analyst expectations of $310 billion, as per Fiscal.ai data.

Shares of online travel company MakeMyTrip Ltd. (MMYT) fell over 12% on Wednesday after the company received target price cuts from Morgan Stanley and Citi following its third-quarter (Q3) 2026 results.

Citi cut MakeMyTrip’s price target to $96 from $108, while maintaining a ‘Buy’ rating on the shares after its earnings results.

Meanwhile, Morgan Stanley lowered its price target on MakeMyTrip to $106 from $113 while maintaining an ‘Overweight’ rating on the shares.

Earnings Results

The company missed revenue estimates, reporting quarterly revenue of $295.7 billion, compared to analyst expectations of $310 billion, as per Fiscal.ai data.

However, MakeMyTrip beat analyst expectations on earnings per share, reporting $0.07 EPS for the quarter, versus an expectation of $0.01.

For the quarter, the company’s adjusted net profit grew to $51.4 million versus $44.9 million in the same period last year, an improvement of $6.5 million. The company also reported a 11.8% increase in gross bookings. The company’s profit for the quarter decreased almost 73% year-on-year to $7.3 million in Q3 26, compared to $27.1 million in Q3 25.

Street Consensus

Morgan Stanley said it lowered its price target on MakeMyTrip after the company's latest earnings report. The analyst said it lowered its estimates to moderate the expected pace of margin expansion for FY27 and FY28, according to TheFly.

Meanwhile, Citi said that it views MakeMyTrip’s growth as solid amid "challenging circumstances," according to TheFly. However, the analyst lowered its estimates after the company’s earnings, factoring in more modest margin assumptions.

Citi, however, said that it views MakeMyTrip's valuation as attractive at current share levels.

How Did Stocktwits Users React?

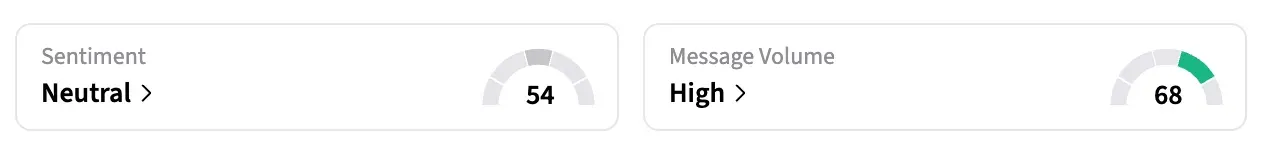

On Stocktwits, retail sentiment around MMYT shares remained in the ‘neutral’ territory over the past 24 hours amid ‘high’ message volumes.

Shares of MMYT lost over 34% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)