Advertisement|Remove ads.

Why Is CETX Stock Falling Today?

- Cemtrex said it plans to use the $2 million proceeds for general corporate purposes, including working capital and future acquisitions.

- The company signed an LOI to acquire a Tennessee-based industrial services provider.

- CETX is on track for a third consecutive session of decline after surging nearly 130% on Monday.

Cemtrex (CETX) stock fell 16% on Thursday after the company announced a $2 million share sale agreement and provided updates on its M&A strategy.

CETX is on track for a third consecutive session of decline after surging nearly 130% on Monday.

Share Sale Agreement

Cemtrex announced a definitive agreement to sell 666,667 shares to a single institutional investor at $3 per share, with expected gross proceeds of $2 million. This is below its current trading price of $3.50.

The company said it plans to use the funds for general corporate purposes, including working capital and future acquisitions, as it advances a multi-year plan to improve margins, scale operations, and strengthen long-term earnings prospects.

Update On Acquisitions

The company also reported progress on its acquisition strategy, highlighting the near completion of its purchase of a Texas-based aerospace and defense engineering firm. This deal is expected to expand Cemtrex’s technological capabilities and contribute to operating income beginning in fiscal 2026.

After deciding not to pursue a robotics integration firm due to updated financial visibility, the company signed a new letter of Intent (LOI) to acquire a Tennessee-based industrial services provider, with closing targeted for the first quarter of 2026. Cemtrex added that it continues to prioritize profitability and is tightly managing its cost structure.

How Did Stocktwits Users React?

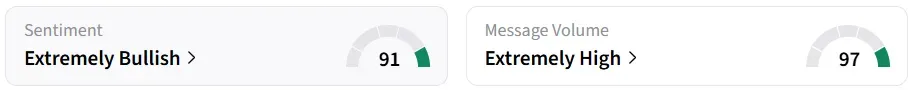

Despite the decline over the past three sessions, retail sentiment on Stocktwits remained ‘extremely bullish’ over the past 24 hours, amid ‘extremely high’ message volumes.

A Stocktwits user sounded bullish about the company’s 2026 outlook.

Cemtrex had undergone a one-for-fifteen reverse stock split on September 29. The stock has lost over 91% of its value this year.

Read also: RZLT Stock Lost Nearly 90% Of Its Value Today – What Did The Company’s Latest Trial Reveal?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_72608012_jpg_3da2f4e2a2.webp)