Advertisement|Remove ads.

Why Is Railroad Firm CSX’s Stock Rising In Premarket Trading?

CSX (CSX) stock gained 1.3% in premarket trading on Thursday after RBC Capital Markets upgraded the stock to ‘Outperform’ from ‘Sector Perform.’

According to TheFly, the brokerage also lifted the price target to $39 from $37. The new price target implied an upside of 19% compared to the stock’s previous closing price.

The brokerage reportedly sees CSX shares as well-positioned under any consolidation scenario in the railroad sector, regardless of the outcome of the pending merger between Union Pacific and Norfolk Southern.

The brokerage also noted that CSX's operations have "improved meaningfully" in recent months despite the company still working through ongoing construction on the Howard Street Tunnel and the Blue Ridge projects.

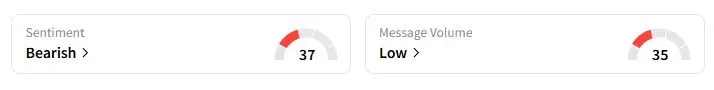

Retail sentiment on Stocktwits about CSX was in the ‘bearish’ territory at the time of writing.

Railroad firms have seen renewed interest over the past few weeks, following Union Pacific's agreement to buy Norfolk Southern, which will create a coast-to-coast powerhouse. If the $85 billion deal is approved, it would reduce the number of so-called Class I railroads to just three.

The company is under pressure from activist investor Ancora, which has urged CSX to pursue a merger with a rival railroad operator or remove CEO Joe Hinrichs, on concerns that CSX would be at a disadvantage following the merger between Union Pacific and Norfolk Southern.

Hinrichs stated last month that CSX is currently focused on its recent partnership with Berkshire Hathaway’s BNSF Railway, before adding that the partnership enables the companies to collaborate and improve their business without having to wait for regulatory approval.

CSX stock has gained marginally this year, compared with 3.7% gains in the S&P 500 Transportation index.

Also See: Why Is Drone Maker Red Cat’s Stock Sliding Over 8% Premarket?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)