Advertisement|Remove ads.

PYPL Stock Has Shed 30% Over Past 10 Sessions – So Why Is Retail Still Bullish?

- The sharpest drop came after its disappointing fourth-quarter results on February 3, when the shares closed 20% lower.

- Users see the stock as undervalued with a low price-to-earnings (P/E) ratio.

- Earlier this week, UBS said competitive risks are offset by solid free cash flow and PayPal’s two-sided network.

PayPal Holdings (PYPL) has come under the spotlight after its shares declined for 10 consecutive sessions, reaching a level last seen around 9 years ago.

While PYPL shares inched 0.3% higher on Friday, the relentless selloff has wiped out more than 30% of the stock’s value in the last 10 sessions. The sharpest drop came after its disappointing fourth-quarter results on February 3, when the shares closed 20% lower.

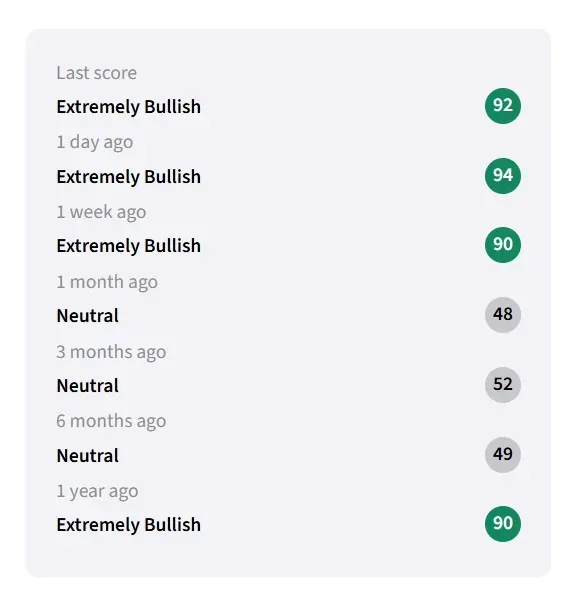

Retail chatter on Stocktwits about the stock has picked up over the past week, with message volume up 19% during that period. Interestingly, despite the decline in share price, retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory over the past week.

Retail Users Feel PYPL Stock Is Undervalued

A Stocktwits user believes the stock is undervalued, citing a low price-to-earnings (P/E) ratio and strong cash flow as signs of long-term potential. The stock has a P/E ratio of 7.59, according to TradingView data.

One user remains bullish on Venmo, PayPal’s mobile payments unit.

Alongside the earnings, PayPal appointed HP boss Enrique Lores as CEO effective March 1, replacing Alex Chriss.

One user stated that the stock will remain rangebound until the new chief executive officer takes over in March.

Q4 Results Snapshot

PayPal reported fourth-quarter revenue of $8.68 billion, up 4% year over year but below the $8.79 billion estimate, according to Fiscal.ai data, while adjusted earnings of $1.23 per share also missed expectations of $1.29 per share. The company forecast first-quarter 2026 adjusted EPS of $1.33.

Following the results update, Wells Fargo cut PayPal’s price target to $48 from $67 and maintained an ‘Equal Weight’ rating, citing company-specific execution issues rather than broader payments-sector weakness, according to The Fly

UBS cut PayPal’s price target to $44 from $65 and maintained a ‘Neutral’ rating. The firm cited execution missteps, especially in Branded Checkout, and warned that planned investments could weigh on margins through 2026. However, competitive risks are offset by solid free cash flow and PayPal’s two-sided network, keeping the risk-reward balanced, the firm added.

The stock has shed around 32% so far this year.

Read also: WTO Stock Plummets 37% Today, But Retail Expects Shares To Go Parabolic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)