Advertisement|Remove ads.

Why TSMC Stock Is Slipping Premarket Today Despite Q3 Revenue Beat

Taiwan Semiconductor Manufacturing Company Ltd. (TSM), widely known as TSMC, reported third-quarter revenue that exceeded the year-ago number and aligned with the guidance issued by the company in mid-July. The stock, however, slipped 0.33% in the early premarket session on Thursday.

The Hsinchu, Taiwan-based foundry reported third-quarter revenue of NT$989.92 billion ($32.47 billion) compared to NT$756.69 billion reported a year ago, marking 30% year-over-year (YoY) growth. The guidance for the quarter was $31.8 billion to $33 billion. Analysts, on average, estimated revenue of NT$973.26 billion, according to Reuters. The revenue growth, however, slowed from the previous quarter’s 38.6%.

The premarket weakness may have been due to slower revenue growth and nervousness among market participants amid a record-breaking streak, underpinned by the strength of the tech sector.

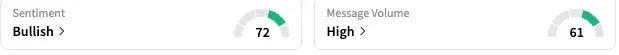

Reflecting the ongoing fundamental strength, the U.S.-listed shares of TSMC have gained about 56% this year, outperforming Nvidia’s 41% rise. On Stocktwits, retail sentiment toward TSMC stock remained in ‘bullish’ territory, although the level of optimism improved from the day before. The message volume on the stream also remained at ‘high’ levels.

A bullish user remarked that TSMC’s chips were selling like hot cakes.

Another user predicted a 2.4% premarket gain following the numbers.

TSMC, which makes chips using advanced processor node technologies, is the major supplier to global tech corporations, including Apple, Nvidia, and AMD. The company’s advanced chips are used in artificial intelligence (AI) systems and applications. While issuing guidance in mid-July, the company said it expects its business to be supported by strong demand for its leading-edge process node technologies.

TSMC's stock has moved in a 52-week range of $134.25-$307.30, and its trades just shy of the all-time high hit earlier this week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Nvidia Stock Is Rising Over 1% In Today’s Premarket

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)