Advertisement|Remove ads.

Here’s Why Varonis Stock Has Tanked Nearly 45% Today

- Varonis shares were down nearly 45% in early trade on Wednesday.

- Jefferies and Barclays slashed the company’s price target, citing the reduction in full-year guidance of annual recurring revenue.

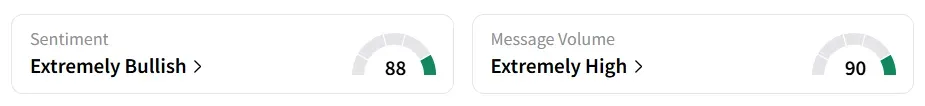

- Despite the dip in share price, retail sentiment on Stocktwits soared to ‘extremely bullish’

Shares of Varonis Systems Inc. (VRNS) plummeted nearly 45% to $35.5 on Wednesday due to a series of price target cuts after the company slashed its full-year annual recurring revenue (ARR) outlook.

Varonis lowered its full-year ARR guidance due to weaker performance in its on-premises subscription business during the final weeks of the third quarter (Q3) and its decision to phase out its self-hosted solution.

Brokerages Cut Price Target

Jefferies lowered Varonis’ price target to $60 from $75 while maintaining a ‘Buy’ rating, according to TheFly. The brokerage was surprised by the end-of-life of the 24% of ARR on-premises by the end of 2026, but sees precedent in “ripping the Band-Aid off SaaS conversions” and unlocking shareholder value, as long as there are no competitive issues.

Barclays lowered its price target for Varonis to $50 from $70, but kept an ‘Overweight’ rating. The company missed annual recurring revenue estimates in Q3 and lowered its fiscal 2025 ARR guidance due to a softer U.S. federal environment and higher churn in on-premises, it wrote in a note.

Meanwhile, Piper Sandler cut Varonis’ price target to $45 from $50 while keeping a ‘Neutral’ rating. The firm cited weaker on-prem renewals that led to an ARR miss, a softer full-year outlook, and a 5% workforce reduction. It also noted added uncertainty from the company’s decision to end its on-prem solutions and a conservative fourth quarter (Q4) guidance.

Q3 Earnings Fineprint

The data security firm missed revenue expectations and issued weak guidance, highlighting pressure in its on-premises subscription business. The company reported Q3 revenue of $161.6 million, below street estimates of $166.4 million.

For Q4 2025, Varonis expects revenue between $165 million and $171 million, up 4% to 8% year-over-year (YoY), and operating income of up to $3 million. For the full year, Varonis projects ARR between $730 and $738 million, reflecting 14% to 15% growth, and a revenue between $615 million and $621 million, up 12% to 13%.

Varonis also authorized a share repurchase program of up to $150 million, which is expected to be completed over the next 12 months.

What Are Retail Investors Saying?

Despite the steep intraday decline, retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a session earlier. Market chatter was at ‘extremely high’ levels.

One user was bullish, expecting a short squeeze due to the share buyback.

Year-to-date, VRNS’ stock has gained around 41%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)