Advertisement|Remove ads.

VNDA Stock On Track To Open At Three-Year High – FDA Clears First New Motion Sickness Drug In Decades

- Two Phase 3 real-world trials, conducted on boats, showed that NEREUS significantly reduced vomiting compared with placebo.

- Vanda is also advancing Tradipitant in clinical development for gastroparesis and nausea linked to GLP-1 therapies.

- Jefferies raised VNDA stock target price to $7.5 from $5, stating Nereus is a potential $100–$300 million opportunity.

Shares of Vanda Pharmaceuticals (VNDA) surged over 18% in pre-market trading on Wednesday after the company received U.S. Food and Drug Administration (FDA) approval for NEREUS (Tradipitant), a motion-sickness treatment aimed at preventing vomiting.

VNDA shares are on track to open at their highest levels in over three years.

The FDA approval marks the first new pharmacologic treatment for motion sickness in more than 40 years. Vanda expects to launch NEREUS in the coming months.

Strong Clinical Evidence

The FDA’s decision was supported by data from three clinical studies involving patients with documented histories of motion sickness. Two Phase 3 real-world trials, conducted on boats, showed that NEREUS significantly reduced vomiting compared with placebo. In the Motion Syros study, vomiting rates fell to roughly 18%-20% with NEREUS, compared with more than 44% with placebo.

Similar results were seen in the Motion Serifos trial, where risk reductions exceeded 50%–70%. Across all studies, the drug demonstrated a favorable safety profile consistent with short-term use.

Motion-induced vomiting is triggered by conflicting signals between the eyes, inner ear, and body sensors, which activate nausea pathways in the brain. NEREUS works by selectively blocking neurokinin-1 (NK-1) receptors, directly targeting a key mechanism responsible for nausea and vomiting.

“This approval underscores the strong scientific evidence in the antiemetic effects of NEREUS™ in motion sickness. For the first time in over 40 years, patients have access to a novel therapy grounded in modern neuropharmacology, offering effective prevention without the limitations of existing options,” said Mihael H. Polymeropoulos, President, CEO, and Chairman of the Board of Vanda Pharmaceuticals.

Beyond motion sickness, Vanda is advancing tradipitant in clinical development for other conditions driven by similar pathways, including gastroparesis and nausea linked to GLP-1 therapies. Last month, Vanda reported that Tradipitant cut vomiting by 50% versus placebo in a trial for nausea and vomiting caused by the GLP-1 drug Wegovy in overweight and obese adults.

Jefferies Raises Price Target

Jefferies raised its price target on Vanda Pharmaceuticals to $7.50 from $5, maintaining a ‘Hold’ rating after the FDA approved Nereus, according to The Fly.

The firm sees Nereus as a potential $100 million – $300 million opportunity for preventing motion-induced vomiting and expects it to be priced above over-the-counter alternatives like Dramamine. Jefferies also notes the approval supports the drug’s acute use in other indications, including GLP-1–associated nausea and vomiting.

How Did Stocktwits Users React?

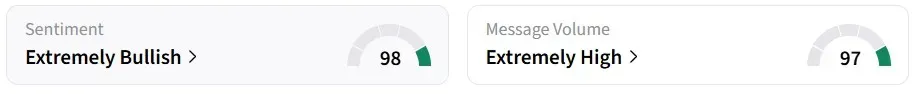

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes. VNDA was also among the top trending stocks on the platform at the time of writing.

One user expects the stock to be a ‘multi-day runner’ due to the approval.

Year-to-date, the shares have gained around 45%.

Read also: Arthur Hayes Continues Ethereum Exit With Fresh $2 Million DeFi Token Buying Spree

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)