Advertisement|Remove ads.

Will Inox Wind Break Out? SEBI RA Rajneesh Sharma Sees ₹176 As Make-Or-Break Level In A Weekly Setup

Inox Wind is trading in a crucial technical range after the stock attempted to maintain its medium-term uptrend.

According to SEBI-registered analyst Rajneesh Sharma, the stock is trading inside an up-channel and has support near the ₹155–₹160 zone, while resistance is seen at ₹200.

https://stocktwits.com/Rajneesh_Sharma_Official/message/619542833

A strong move above ₹176 will keep the doors open for a move towards ₹200 and higher to over ₹240, but a break below ₹155 will invalidate the bullish setup.

Volume is still average, and the relative strength index (RSI) is flat. The analyst said that further confirmation with stronger momentum is needed.

The technical setup comes after the National Company Law Tribunal approved the merger of Inox Wind Energy into Inox Wind in June. The merger simplifies the InoxGFL Group’s wind energy business, eliminates the holding company structure, and reduces IWL’s liabilities by approximately ₹2,050 crore.

Inox Wind will issue 632 equity shares for every 10 shares of Inox Wind Energy as part of the merger.

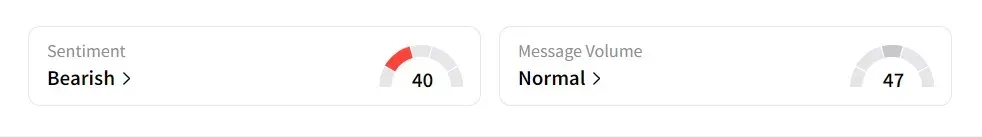

On Stocktwits, retail sentiment was ‘bearish’ amid ‘normal’ message volume.

The stock has declined 8.2% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)