Advertisement|Remove ads.

Williams-Sonoma CEO Cashes Out Nearly $5M In Shares: Retail Sentiment Turns Bearish

Williams-Sonoma (WSM) Chief Executive Officer Laura Alber has sold company shares worth $4.93 million as part of a pre-approved trading plan.

According to a securities filing, the chief of the home improvement products retailer sold 30,000 shares last week for $162.62 to $165.85 per share.

While insider share sales are generally considered negative news and signal a potential stock downside, top executives occasionally sell shares for purely compensatory reasons.

The transaction follows Williams-Sonoma's quarterly report, which indicated that the business is improving.

The retailer delivered better-than-expected first-quarter results and reiterated its full-year forecast, signaling confidence that sales will comfortably offset the headwinds from tariffs.

Alber said in a recent interview with CNBC that the company is exploring ways to increase manufacturing in the U.S., and she claimed that most of the outfit's upholstery is being made and assembled domestically.

Williams-Sonoma owns the namesake home goods and furniture chain, as well as Pottery Barn and West Elm.

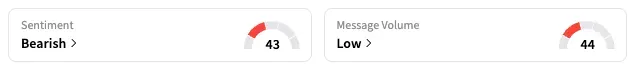

On Stocktwits, retail sentiment for the company dropped to 'bearish' from 'neutral' a day ago.

Although the filing regarding Alber's stock sale came in after-market hours, Williams-Sonoma stock closed 2.2% lower in the regular session, while the benchmark S&P 500 (SPX) closed 0.4% higher.

WSM stock is down 14.6% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)