Advertisement|Remove ads.

Will Wipro Break Past ₹274? SEBI RA Flags Upside Potential Ahead Of Q1 Earnings

IT services giant Wipro is expected to report its Q1FY26 results on Thursday, with Dalal Street hoping for a sentiment boost following disappointing performances by peers Tata Consultancy Services (TCS) and HCL Technologies.

While topline growth may be muted due to weak demand in Europe and cautious client spending, its profit after tax is projected to rise between 5% and 12%, supported by stable margins resulting from cost control and currency benefits, according to reports.

Technically, all eyes will be on whether the stock can break above the key resistance level at ₹274.15, said SEBI-registered analyst Rohit Mehta.

Wipro shares are currently in a sideways to mildly bullish trend, consolidating just below this resistance zone. A sustained breakout above ₹274 could open the path toward the next resistance at ₹324.20, with long-term upside capped near its all-time high of ₹357.55, said Mehta. The stock is expected to find support between ₹218 and ₹228.

The overall trade setup appears to be improving after a prolonged period of range-bound trading. A bullish breakout on higher volume could confirm institutional interest returning ahead of earnings.

Fundamentally, Wipro’s performance in the March 2025 quarter showed steady progress with sales and operating profit increasing. Promoters slightly trimmed their stake to 72.67%. Foreign institutional investors (FIIs) pared down holdings, but domestic investors (DIIs) increased their stake from 7.47% to 7.78%.

While long-term sales growth has been modest at 7.82% over five years, the company’s stable 19.1% dividend payout and consistent profitability remain positives.

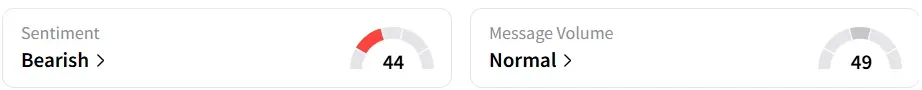

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a week ago.

The stock closed 1.9% higher at ₹262.40, having shed more than 13% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)