Advertisement|Remove ads.

Howmet Aerospace In Spotlight After Reportedly Planning To Halt Orders On Tariff Concerns, Retail’s Still Bullish

Howmet Aerospace (HWM) stock garnered retail attention over the weekend after a report said that the aerospace firms might halt some shipments if tariffs impact them.

Reuters reported, citing a letter, that the company has declared a force majeure event. It is a legal practice that permits any party to avoid contract obligations if an unexpected event prevents them from fulfilling them.

"Howmet will be excused from supplying any products or services that are impacted by this declared national emergency and/or the tariff executive order," Howmet wrote in the letter, according to the report.

Last week, U.S. President Donald Trump unveiled tariffs on imports from around the world, which effectively raised American companies' manufacturing costs.

According to the report, Howmet, whose customers include plane makers Airbus and Boeing, was seemingly the first major aerospace firm to declare a force majeure event after the tariff announcement.

The aerospace industry is already reeling from supply chain disruptions that have delayed aircraft deliveries across the globe.

The report noted that the legal declaration doesn't automatically mean supplies will be halted or disrupted. Still, it does allow Howmet to claim it cannot fulfill its contracts if the emergency order affects its operations.

According to the report, the letter left room for negotiations over sharing the cost of tariffs, saying Howmet would work with customers, “including discussing your interest in alleviating the impact of the Tariff Executive Order on Howmet."

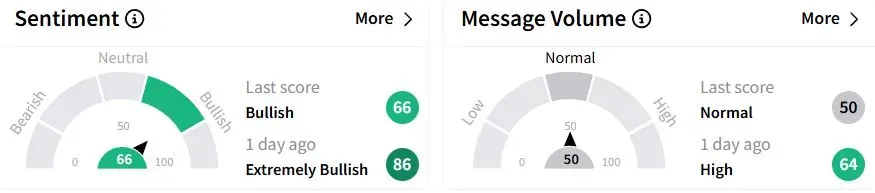

Retail sentiment on Stocktwits was down in the ‘bullish’ (66/100) territory from ‘extremely bullish’(86/100) a day ago, while retail chatter was ‘normal.’

Howmet shares have gained 1.9% year-to-date (YTD).

The company had topped Wall Street’s earnings estimates in February and forecasted first-quarter revenue above analysts’ expectations.

Also See: Capri's Versace Deal With Prada Could Reportedly Drop This Week: Retail Investors Eye Upside

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)